Guernsey Fund Summary

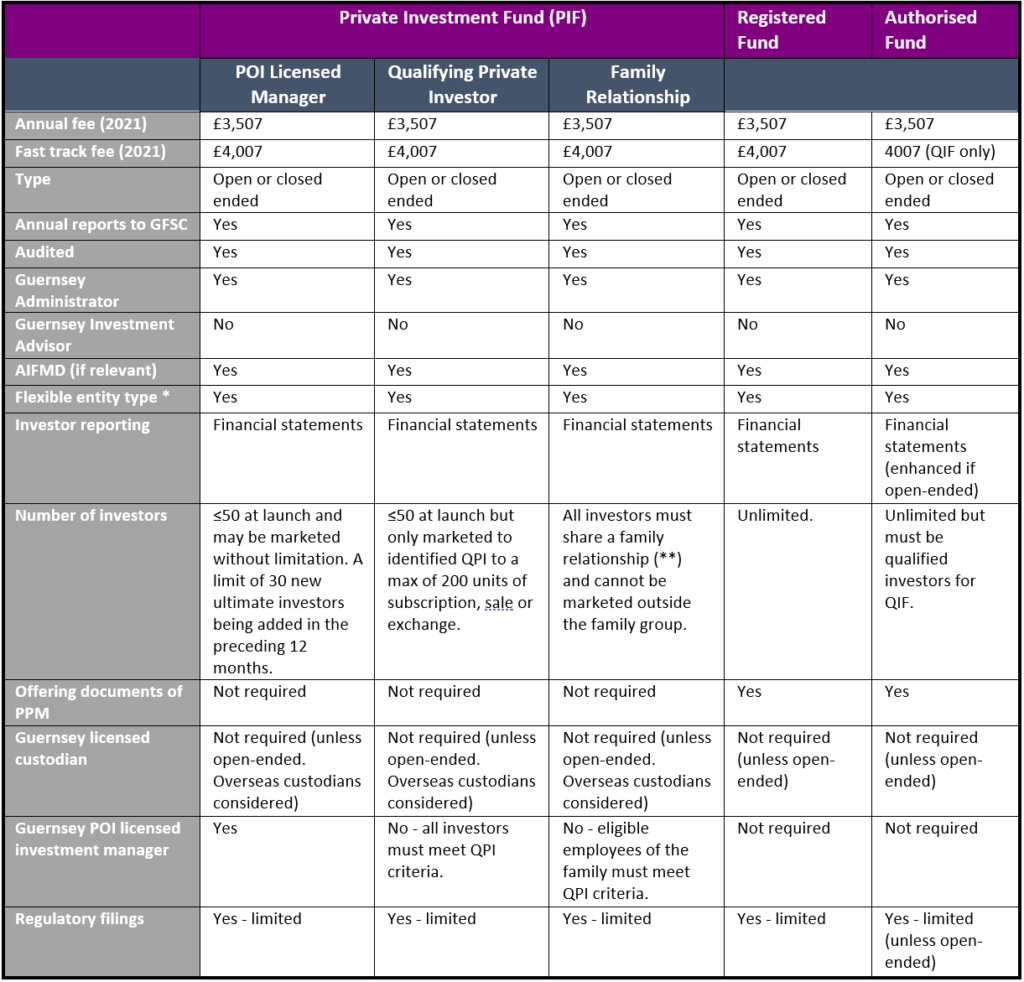

As an additional aide to our notes on the introduction of the two new Private Investment Fund (PIF) routes in Guernsey (Qualifying Private Investor and Family Relationship);

A Quick Guide to Guernsey’s New Private Investment Fund (PIF) Rules (dixcart.com)

The ‘Qualifying’ Private Investor Fund (PIF) Guernsey Private Investment (dixcart.com)

A summary Is provided below on the three routes to establishing a PIF and, for completeness, the same information for registered and authorised funds.

| * Flexible entity type: such as Limited company, Limited partnership, Protected Cell Company, Incorporated Cell Company etc. |

| ** No hard definition of ‘family relationship’ is provided, which could allow for a wide range of modern family relationships and family dynamics to be catered for. |

Additional information:

Registered vs authorised – in registered collective investments schemes it is the responsibility of the designated manager (administrator) to provide warranties to the GFSC that appropriate due diligence has taken place. On the other hand, authorised collective investment schemes are subject to a three-stage application process with the GFSC in which this due diligence takes place.

Authorised fund classes:

Class A – open-ended schemes compliant with the GFSCs Collective Investment Scheme Rules and thus suitable for sale to the public in the United Kingdom.

Class B – the GFSC devised this route to provide some flexibility by allowing the GFSC to exhibit some judgment or discretion. This is because some schemes range from the retail funds aimed at the general public via institutional funds to the strictly private fund established solely as a vehicle for investment by a single institution, and that their investment objectives and risk profiles are similarly wide-ranging. Accordingly, the rules do not incorporate specific investment, borrowing and hedging restrictions. This also allows for the possibility of new products without the need to amend the Commission’s regulation. Class B schemes are typically aimed at institutional investors.

Class Q – this scheme is designed to be specific and is aimed at professional investor funds encouraging innovation. As such, compliance with this scheme places more focus on disclosure of risks inherent in the vehicle vs other classes.

Dixcart is licensed under the Protection of Investors (Bailiwick of Guernsey) Law 1987 to offer PIF administration services, and holds a full fiduciary license granted by the Guernsey Financial Services Commission.

For further information on private investment funds, please contact Steve de Jersey at advice.guernsey@dixcart.com