Nevis Multiform Foundations – Key Characteristics and Practical Uses

Nevis Multiform Foundation Characteristics

Foundations are often regarded simply as the civil law version of the common law Trust. However, there are a number of distinct characteristics of a Nevis Multiform Foundation which make it stand out as a unique and advantageous wealth planning tool quite separate from a Trust and even that of a Foundation, formed elsewhere in the world. We shall explore these more fully throughout this note.

Legal Personality – the most notable difference between a Foundation and a Trust is that a Foundation possesses a separate legal personality and has the capacity to sue and be sued. A Nevis Multiform Foundation has the capacity, rights, powers, and privileges of an individual person.

Ownership and Purpose – A Foundation is a self-owned entity which does not have shareholders or equity holders, instead it is formed for any purpose which may be charitable, non-charitable, commercial or non-commercial which the management board will carry out on behalf of the Foundation.

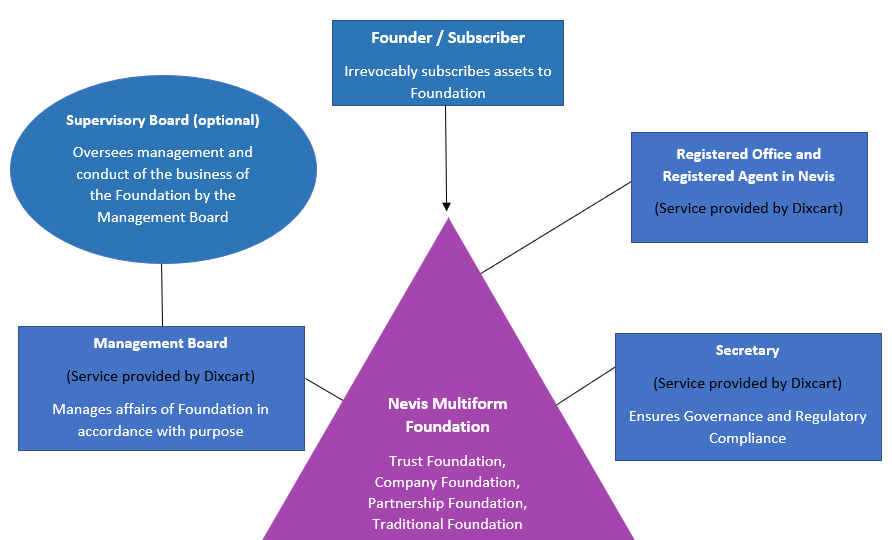

Control – A concern some individuals face when considering settling an offshore Trust, is surrendering complete control in relation to the ownership, investment, and distribution of their assets. Conversely, the Founder of a Foundation (otherwise known as a Subscriber) can maintain an element of control, by becoming a member of the management board and assist in setting the purpose and investment strategy of the Foundation. Alternatively, they can form a supervisory board to oversee the management of the Foundation and fulfilment of the Foundation’s purposes by the Management Board.

Flexibility of Form – the most innovative and beneficial characteristic of setting up a Foundation in Nevis is that it can choose to take a number of different forms including; a trust foundation, company foundation, partnership foundation or a traditional foundation.

Its malleable nature means that it can also swap between forms over its life. This flexibility allows a Founder a broad scope in which to establish their structure and tailor it to suit their needs as they evolve over time.

Creditor Action – As with the protection provided againsta creditor pursuing any frivolous action against trust property held in a Nevis International Exempt Trust, there is similar protection afforded to a Nevis Multiform Foundation.

Before bringing any action or proceeding against any Nevis Multiform Foundation, a Creditor must first deposit a bond to the amount of: USD50,000, with the Minister of Finance.

Foreign Judgements – a judgement made in another jurisdiction is not recognised or enforceable in Nevis.

Validity – no multiform foundation, governed by the laws of Nevis, and no subscription of property to a multiform foundation which is valid under the laws of Nevis, shall be void, voidable or liable to be set aside or defective in any manner, by reference to the law of a foreign jurisdiction

Parties

A typical Nevis Foundation consists of the following parties:

Practical Uses

Family Business Succession Planning

By placing the ownership of a Family Business under a Multiform Foundation, continuity can be afforded to the business and the purpose can be clearly defined. Family members and descendants can also be members of the management board and therefore actively involved with the direction and management of the underlying enterprise.

Educational Foundation

There comes a point where junior members of a family must leave the security and protection of their family for the first time and enter the wider world for education or career purposes. This may mean that they are moving to a larger city or different country but are not yet ready to have full financial independence. A multiform foundation is a good solution in this situation by providing financial assistance to such a member of the family without giving them complete access to a lump sum.

Charitable Foundation

A Multiform Foundation can be established with a specific or multiple charitable purposes. Such purposes could include the relief of poverty, the advancement of education, the advancement of religion, the protection of the environment, the advancement of human rights or any other purpose which is beneficial to the community.

Corporate Stability

Defining the specific purpose for an overlying multiform foundation can ensure that the long term strategic plans of the underlying assets / company are followed and maintained in a consistent manner.

Overcome Forced Heirship

Should the Founder be resident in a country where forced heirship provisions are in force, he/she may wish to establish a Multiform Foundation in Nevis where there are no forced heirship rules and the assets would be distributed in line with the purpose of the Foundation.

Tax Planning

As part of a tax planning strategy, many individuals may utilise a corporate vehicle in a jurisdiction which they do not reside. However, in the jurisdiction of their tax residence they may well be required to report their ownership and interests in this company under controlled foreign corporation reporting requirements.

Instead of holding shares directly, an individual might establish a Multiform Foundation affording anonymity and privacy for the subscriber.

Additional Information

Please contact Dixcart if you require any additional information on this topic: advice@dixcart.com.

Whilst this note is intended to provide information regarding Nevis Multiform Foundation structures and examples of how these can be used, it is not intended to form any sort of legal or tax advice. We strongly recommend that any individual considering setting up a wealth planning structure seek independent legal and tax advice before doing so.