Understanding a Cyprus International Trust

Introduction

Cyprus has been a leading jurisdiction for Trust structures for several years, benefiting from its stable government and business-friendly tax policies.

Dixcart Cyprus is a fully licensed and experienced local Trustee. We have been operating in Cyprus since 2013, but as a group, we have been providing Trustee services to our clients for over 50 years.

This article aims to break down the basics of what a Trust is and the requirements for a valid Trust by explaining the three certainties. We will also highlight the specific benefits of using a Cyprus International Trust and how we can help you establish a lasting legacy.

What is a Trust?

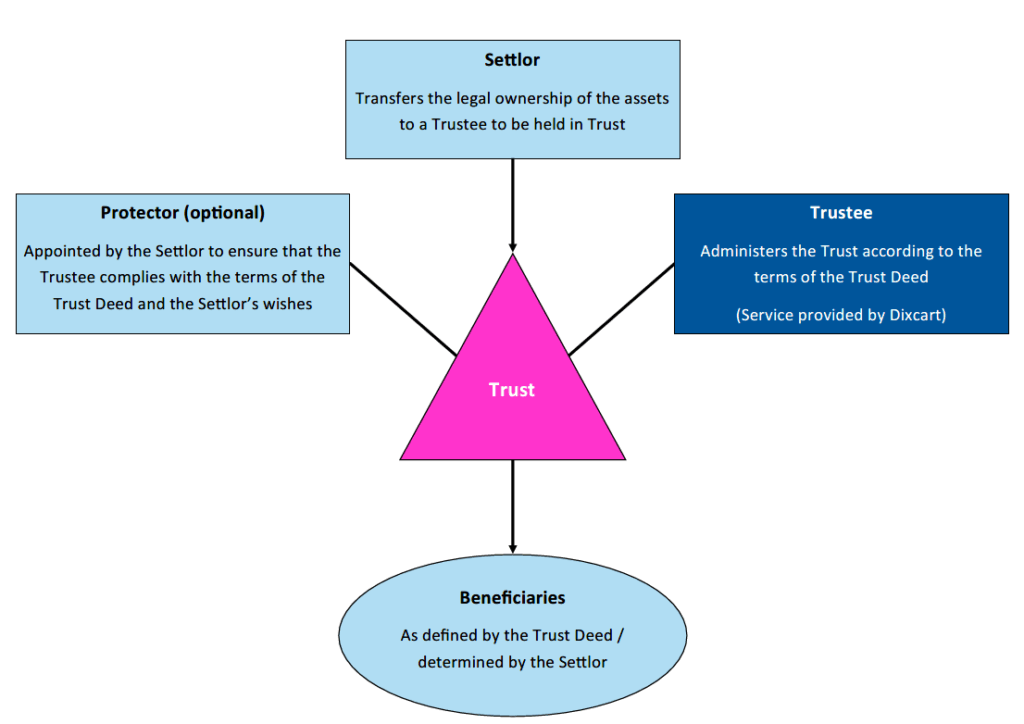

A Trust is a legal arrangement where one party, known as the Settlor, transfers assets to another party, the Trustee, to hold and manage those assets for the benefit of third parties, the Beneficiaries. The Trustee is legally obliged to manage the Trust assets in accordance with the terms of the Trust Deed and the applicable laws, ensuring that the beneficiaries’ interests are safeguarded.

What are the Three Certainties?

- The Certainty of Intention: The Settlor must clearly express an intention to create a Trust, ensuring that the legal ownership of the assets is genuinely transferred to the Trustee to hold for the benefit of defined beneficiaries. This is evidenced by an executed Trust Deed and supported by clear communication between the Settlor (or their advisor(s)) and the Trustee, discussing the Settlor’s goals and intentions prior to the Trust’s establishment.

- The Certainty of Subject Matter: The Trust Property must be clearly identified and defined. This can include cash, real estate, shares, or other tangible and intangible assets. The initial settled funds are usually a nominal amount of €1, €10, or €100, as indicated within the Trust Deed, with further assets to be added at a later date.

- The Certainty of Objects: There must be clearly defined Beneficiaries or a Beneficial Class who will benefit from the Trust. This can include the Settlor.

Other Considerations

At the outset, the Settlor should consider whether there are any contingencies for the Beneficiaries benefiting and whether a Protector will be appointed to provide oversight to the structure. Selecting a trusted and experienced Trustee to administer the Trust on behalf of the beneficiaries is also crucial.

While the Settlor relinquishes legal ownership of the assets, they can request the Trustee to undertake certain actions and determine guidelines and conditions regarding how and when the beneficiaries should benefit. However, these requests should be expressed as the Settlor’s Letter of Wishes and are not legally binding, to protect the validity of the Trust Structure and support the certainty of intention. In a Discretionary Trust, the Trustee makes the final decision on whether a Beneficiary should benefit, always adhering to their fiduciary duty to consider the interests of all Beneficiaries before making any disbursements.

The Benefits of a Cyprus International Trust

A Cyprus International Trust (CIT) offers attractive opportunities and incentives for setting up and operating a Trust. Due to these, CITs are regularly utilised by high-net-worth individuals for asset protection, tax planning and wealth management.

Some of the benefits a CIT can offer are as follows:

- Preservation of family wealth and gradual distribution of income and capital to the Beneficiaries.

- Asset protection against creditors, forced heirship rules, or legal action. They are difficult to challenge since the only reason it can be challenged is for defrauding creditors. The burden of proof in this case lies on the creditors.

- Various tax benefits for the parties involved, including:

- No Capital Gains Tax paid on the disposal of assets of a Cyprus Trust

- No estate or inheritance tax

- Income received from local or overseas sources is taxable in Cyprus where the beneficiary is a Cyprus tax resident. If Beneficiaries are non-tax residents of Cyprus, only Cyprus sources of income are taxable under Cyprus’s income tax law.

- Confidentiality is maintained (as far as permitted by relevant laws).

- Flexibility in relation to the powers of the Trustee.

In summary: A well-structured Cyprus International Trust ensures effective legal asset management and protection for Beneficiaries, offering a flexible tool for wealth preservation and succession planning. It also provides confidentiality and can be structured to offer tax efficiency, depending on the jurisdiction of the Settlor and Beneficiaries.

How can Dixcart help you?

Dixcart is a family-owned and operated business, proudly managed by the same family that founded it over 50 years ago. This deep-rooted legacy means working with and supporting families and individuals provide for their futures is part of our DNA, and at the very heart of what we do.

With over 50 years of experience in the sector, we have a wealth of knowledge in Trust management. Our teams offer in-depth expert knowledge on the local regulatory framework, complimented by the backing of our international group of offices, enabling us to deliver tailored solutions for you.

At Dixcart we know that every situation is different, and we treat them as such. We work very closely with our clients, developing a deep understanding of their specific needs, meaning we can offer bespoke services, recommend the most suitable structures, and provide unwavering support at every stage of the process.

If you are considering establishing a Trust, please contact us at advice.cyprus@dixcart.com. We would be delighted to answer your questions and assist you in safeguarding your legacy for generations to come.

The data contained within this Information Note is for general information only. No responsibility can be accepted for inaccuracies. Readers are also advised that the law and practice may change from time to time.