Understanding Progressive Taxation in the UK: Salary, Dividends and Pensions

It is often said that those with the broadest shoulders should bear the heaviest loads. This principle is clearly reflected in the UK tax system, where individuals with a greater ability to pay, contribute a larger share of the overall tax burden. Understanding how this works in practice, particularly for individuals at the highest and lowest ends of the income scale, requires an examination of allowances, marginal rates, and the methods available to extract profits from a company.

Methods of Extraction

When considering how individuals withdraw a value from money a company, three main extraction methods are typically used: Salary, Dividends, and Pension Contributions. Each method carries its own tax implications and must be understood in the context of wider corporate and personal planning.

- Salary

Salary is tax-deductible for corporation tax purposes, which means it reduces the company’s taxable profits. However, it is subject to National Insurance contributions (NICs) for both the employee and the employer, making it potentially more expensive overall.

- Dividends

Dividends are not tax-deductible for corporation tax purposes and therefore must be paid from post-tax profits. They benefit from no liability to National Insurance, which can make them more tax‑efficient for individuals depending on the tax band.

- Pension Contributions

Pension contributions made by a company are corporation tax-deductible, similar to salary. They do not give rise to NIC liabilities, and tax is only paid when the pension income is eventually drawn. This can make pensions extremely tax-efficient as a long-term extraction method.

Marginal Rates

There is an ongoing debate about the fairness and structure of marginal tax rates in the UK. Marginal rates are influenced by several layers of the tax system, including:

- Personal allowance

- Dividend allowance

- National Insurance thresholds

- Corporation tax rates, which themselves include marginal relief depending on profit levels

To understand effective marginal tax rates, it is necessary to consider the entire journey from company profit to the individual receiving income.

Comparing Marginal Rates at the Bottom and the Top

To illustrate the degree of progression in the system, consider £50,000 of company profits either taken out purely as dividends or purely as employment income.

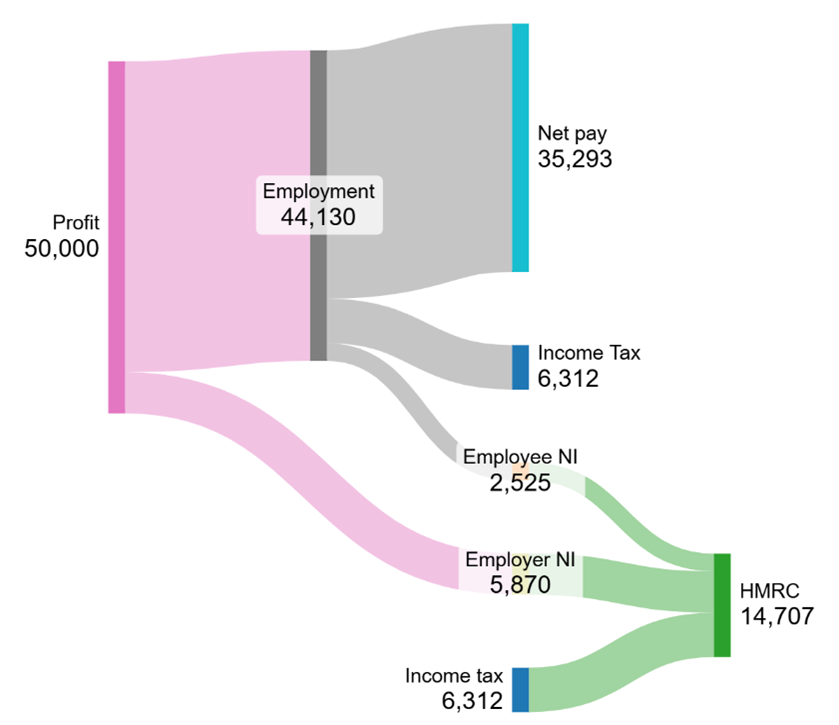

Extracting Value as Employment

A basic‑rate taxpayer with no other income extracting the profits as employment income will typically retain around 71% after all taxes and NICs.

Employment Low Income

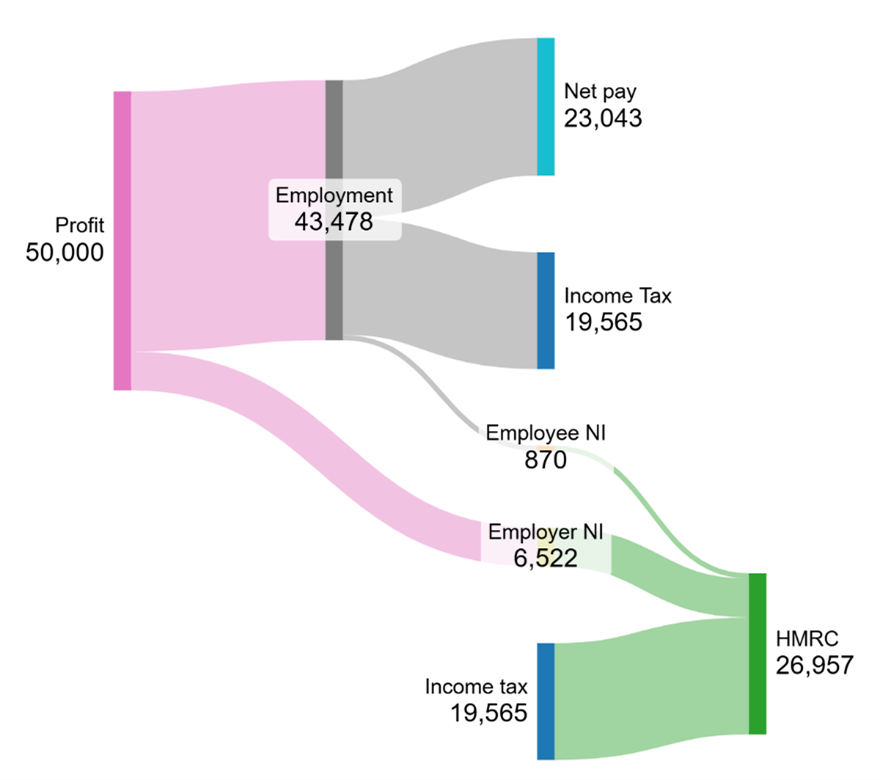

An additional‑rate taxpayer, however, retains only about 46%, reflecting a much higher combined tax burden.

Employment High Income

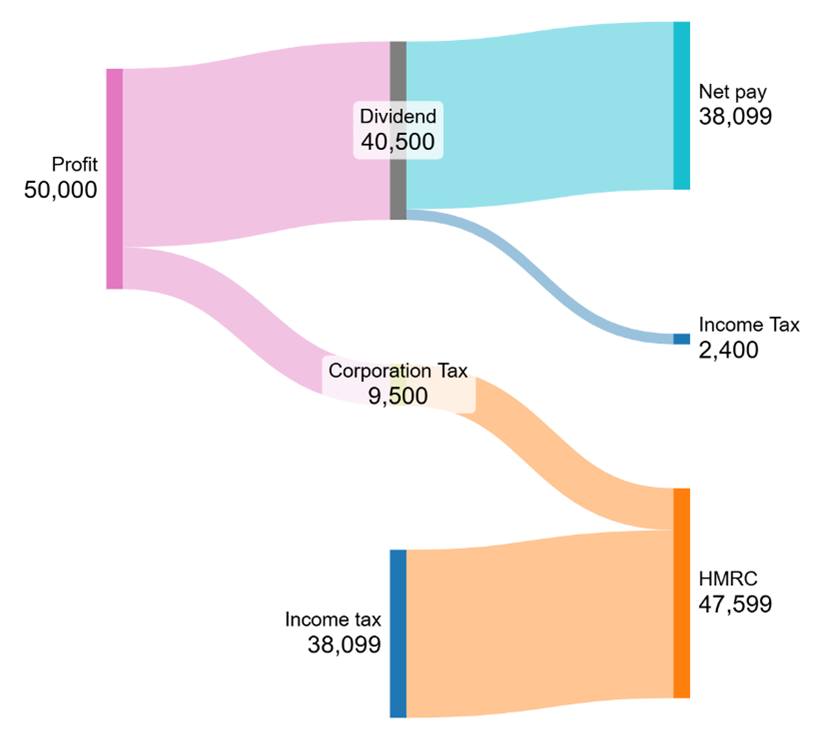

Extracting Value as Dividends

If the basic rate taxpayer with no other income takes the entire amount as dividends they retain roughly 76% of the profit, due to lower tax rates and the absence of NICs.

Dividend Low Income

Of course, this example is not optimal as the basic rate taxpayer would of course be looking to use a combination of employment and dividends.

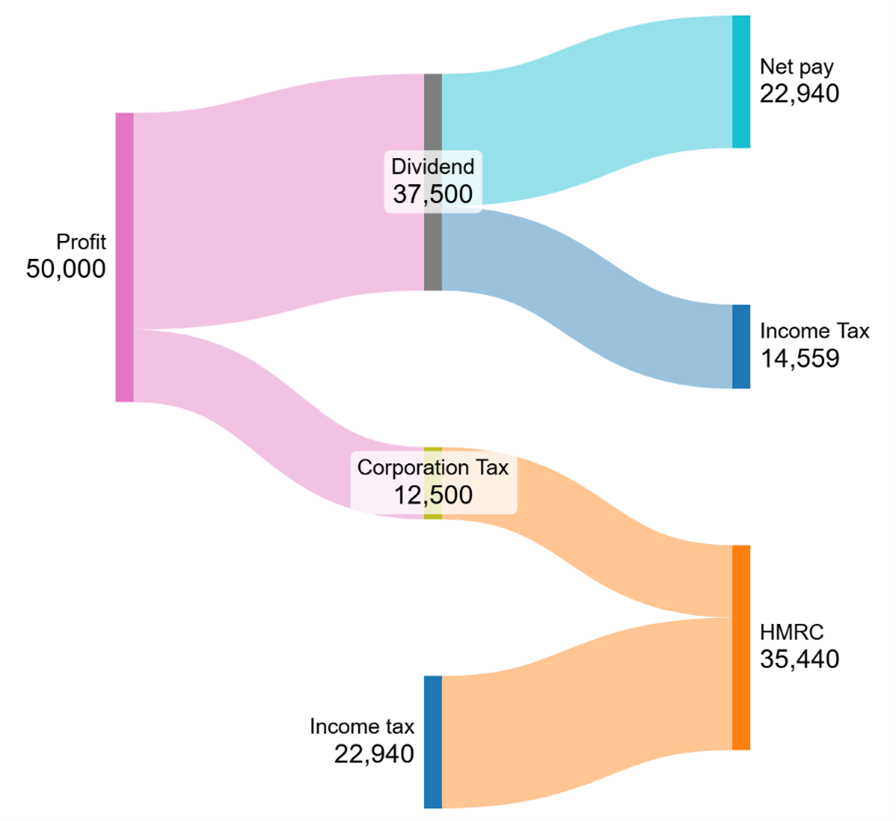

At higher income levels, the additional rate taxpayer taking dividends, retains about 46%, again showing the significantly heavier tax load on higher earners.

Dividend High Income

All numerical figures used in this article are indicative only and may vary depending on factors such as additional income sources, interaction of allowances, personal tax planning choices, and future legislative changes.

Taking Value as Pension Contributions

No consideration of profit extraction would be complete without mentioning pensions. They are extremely tax‑efficient, as contributions reduce corporation tax and avoid Income Tax and NICs at the point of contribution.

However, the rules are becoming more complex. Under proposed changes that are currently envisioned to take effect on 6 April 2029, any “optional remuneration arrangements” involving pension contributions over £2,000 may become subject to National Insurance. Additionally, complexities such as tapering of annual allowances, carry‑forward rules, and taxation of excess contributions make pensions a broad enough subject to warrant separate treatment.

Conclusion

Across salary, dividends and pensions, the UK exhibits a highly progressive tax system. Whether viewed through income tax, dividend tax, National Insurance, or the interaction between corporation and personal taxes, those on higher incomes consistently face a much greater marginal deduction than those on lower incomes.

When determining the most appropriate remuneration strategy, individuals must consider their overallpersonal circumstances, not just the tax implications. Broader financial goals, liquidity needs, retirement timelines, and personal risk preferences all play an essential role in identifying the optimal approach.

Dixcart UK

At Dixcart UK, we recognise that every client’s situation is unique, and we are committed to delivering personalised solutions that address your specific objectives and concerns. In an increasingly complex and regulated tax environment, having the right guidance and support is essential.

For more information, or to talk to us about how we can assist you, please contact: advice.uk@dixcart.com.