Guernsey ist seit langem als führende Gerichtsbarkeit für Treuhandstrukturen anerkannt und bietet ein stabiles, gut reguliertes Umfeld, das sich ideal für die Vermögensverwaltung und Nachfolgeplanung eignet. Bei Dixcart Guernsey verfügen wir seit 1975 über umfangreiche Erfahrung in der Einrichtung und Verwaltung von Treuhandstrukturen, die auf die unterschiedlichen Bedürfnisse unserer Kunden zugeschnitten sind.

Dieser Artikel bietet einen Überblick über die wichtigsten Elemente von Guernsey-Trust-Strukturen, hebt ihre Vorteile hervor und erklärt, warum sie nach wie vor eine beliebte Wahl für Einzelpersonen und Familien sind, die ihr Vermögen schützen und verwalten möchten.

Was ist ein Trust?

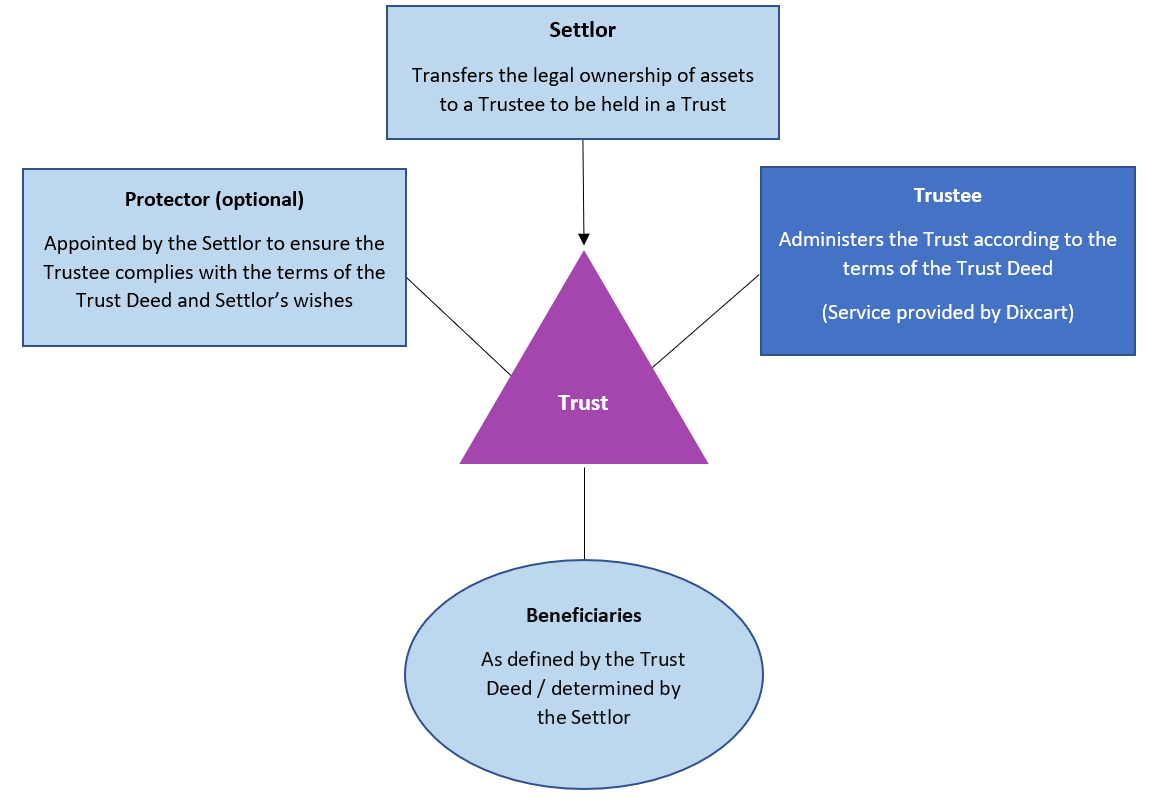

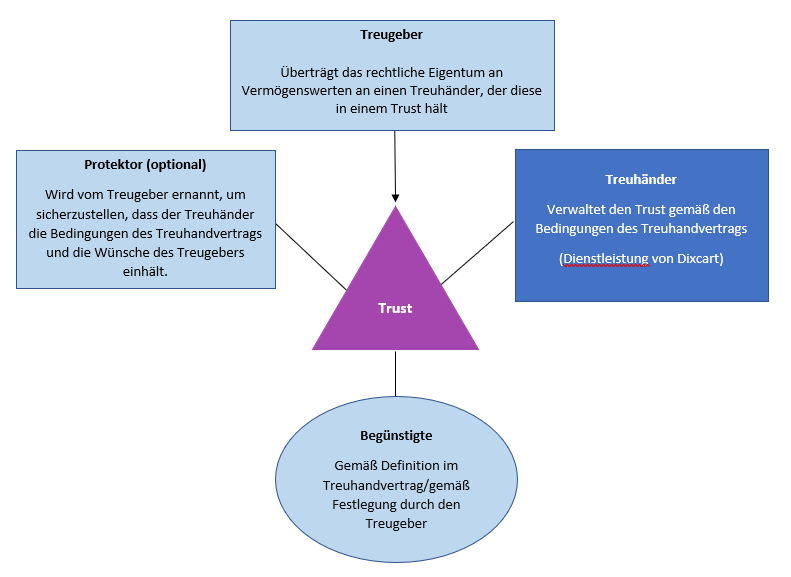

Ein Trust ist eine rechtliche Vereinbarung, bei der eine Partei, der sogenannte Treugeber, Vermögenswerte an eine andere Partei, den Treuhänder, überträgt, um diese zugunsten Dritter, der Begünstigten, zu halten und zu verwalten. Der Treuhänder ist gesetzlich verpflichtet, das Trustvermögen gemäß den Bestimmungen der Treuhandurkunde und den geltenden Gesetzen zu verwalten und sicherzustellen, dass die Interessen der Begünstigten gewahrt werden.

Ein Beispiel für eine typische Treuhandstruktur wäre das Folgende:

Warum eine Treuhandgesellschaft in Guernsey gründen?

- Guter Ruf und lokale Ressourcen – Auf Guernsey sind eine Reihe regulierter professioneller Treuhänder ansässig, die zusammen mit einer Vielzahl professioneller Wirtschaftsprüfungs- und Anwaltskanzleien für den reibungslosen Ablauf eines Guernsey-Trusts sorgen. Darüber hinaus genießt die Gerichtsbarkeit hohes Ansehen, hat weltweit einen ausgezeichneten Ruf und wird von Dritteinrichtungen wie Banken und Kreditgebern anerkannt.

- Steuereffizienz: Guernsey-Trusts können je nach Steuerwohnsitz des Gründers und der Begünstigten steuereffizient strukturiert werden. Obwohl Guernsey keine Kapitalertrags-, Erbschafts- oder Vermögenssteuern erhebt, ist es unerlässlich, professionellen Rat einzuholen, um die Einhaltung aller relevanten Steuerpflichten in anderen Gerichtsbarkeiten sicherzustellen.

- Vertraulichkeit: Treuhandgesellschaften in Guernsey profitieren von einem hohen Maß an Vertraulichkeit. Es gibt kein öffentliches Register für Treuhandgesellschaften und Angaben zum Treugeber, zu Begünstigten und zum Treuhandvermögen bleiben vertraulich.

- Vermögensschutz: Treuhandgesellschaften in Guernsey können zum Schutz von Vermögenswerten vor potenziellen künftigen Forderungen von Gläubigern oder zum Schutz von Familienvermögen vor potenziellen Streitigkeiten eingesetzt werden. Der solide Rechtsrahmen in Guernsey unterstützt die Nutzung von Treuhandgesellschaften zum Vermögensschutz, vorausgesetzt, die Treuhandgesellschaft wurde nicht mit der Absicht gegründet, Gläubiger zu betrügen.

- Nachfolgeregelung: Treuhandvermögen können ein wirksames Instrument für die Nachfolgeregelung sein, da sie es den Treugebern ermöglichen, die Verteilung ihres Vermögens nach ihren Wünschen zu regeln. Treuhandvermögen können so strukturiert werden, dass sie für nachfolgende Generationen sorgen und sicherstellen, dass das Familienvermögen erhalten bleibt und kontrolliert weitergegeben wird.

- Flexibilität und Kontrolle: Guernsey Treuhandgesellschaften bieten eine erhebliche Flexibilität in Bezug auf ihre Struktur und Verwaltung. Treugeber können in der Treuhandurkunde spezifische Bedingungen festlegen und durch die Nutzung von Treuhandgesellschaften mit Ermessensspielraum oder privaten Treuhandgesellschaften einen gewissen Einfluss auf die Verwaltung des Trusts ausüben.

- Rechtssicherheit und Stabilität: Das Treuhandrecht von Guernsey ist gut etabliert und bietet Treugebern, Treuhändern und Begünstigten Rechtssicherheit und Stabilität. Das Rechtssystem der Gerichtsbarkeit basiert auf dem englischen Common Law, das für seine Klarheit und Vorhersehbarkeit bekannt ist.

Arten von Treuhandgesellschaften in Guernsey

Guernsey bietet eine Vielzahl von Treuhandstrukturen, um unterschiedlichen Kundenbedürfnissen gerecht zu werden, darunter:

- Discretionary Trusts (Ermessenstreuhandgesellschaft): Bei einem Discretionary Trust hat der Treuhänder die Befugnis, im Rahmen der Bestimmungen der Treuhandurkunde festzulegen, wie das Einkommen und das Kapital des Trusts unter den Begünstigten verteilt werden. Diese Art von Trust bietet Flexibilität bei der Reaktion auf sich ändernde Umstände und kann ein wirksames Instrument zum Schutz von Vermögenswerten sein.

- Fixed Interest Trusts (Festzinstreuhandgesellschaft): Hier haben die Begünstigten einen festen Anspruch auf das Einkommen oder das Kapital des Trusts, wie in der Treuhandurkunde festgelegt. Diese Trusts werden in der Regel verwendet, wenn der Treugeber sicherstellen möchte, dass bestimmte Begünstigte festgelegte Beträge erhalten.

- Accumulation and Maintenance Trusts (Anspar- und Unterhalts Trusts): Diese Trusts werden häufig zugunsten von Minderjährigen eingesetzt und ermöglichen die Anhäufung von Erträgen, bis die Begünstigten ein bestimmtes Alter erreicht haben. Ab diesem Zeitpunkt haben sie Anspruch auf die Erträge oder das Kapital.

- Purpose Trusts (Zwecktreuhandgesellschaft): Im Gegensatz zu herkömmlichen Trusts, die bestimmten Einzelpersonen zugutekommen, werden Zwecktreuhandgesellschaften zur Erreichung eines bestimmten Zwecks gegründet, der spezifisch, angemessen und durchsetzbar sein muss. Diese werden häufig bei Handelsgeschäften oder zur Beteiligung an einer privaten Treuhandgesellschaft eingesetzt.

- Private Trust Companies (Privattreuhandgesellschaften) (PTCs): PTCs sind Treuhänder, die als Treuhänder für einen bestimmten Familientreuhandfonds oder eine Gruppe von Treuhandfonds eingesetzt werden. Sie bieten dem Treugeber oder seiner Familie ein höheres Maß an Kontrolle und können besonders für Familien mit komplexen oder bedeutenden Vermögenswerten von Vorteil sein.

Einrichtung einer Guernsey Treuhandgesellschaft

Die Gründung einer Treuhandgesellschaft in Guernsey umfasst mehrere wichtige Schritte:

- Beratung und Planung: Der erste Schritt besteht darin, mit einem qualifizierten Treuhand- und Unternehmensdienstleister wie Dixcart Guernsey zusammenzuarbeiten, um Ihre spezifischen Bedürfnisse und Ziele zu verstehen. So wird sichergestellt, dass die Treuhandstruktur auf Ihre persönlichen oder familiären Umstände zugeschnitten ist. Es handelt sich hierbei nicht um eine Struktur, die für alle passt, und alle Aspekte müssen sorgfältig abgewogen werden.

- Erstellung der Treuhandurkunde: Sobald die Ziele klar sind, wird eine Treuhandurkunde erstellt. Dieses Rechtsdokument legt die Bedingungen des Trusts fest, einschließlich der Aufgaben und Verantwortlichkeiten des Treuhänders, der Rechte der Begünstigten und der Befugnisse des Treugebers (falls vorhanden). Es ist von entscheidender Bedeutung, dass die Urkunde sorgfältig ausgearbeitet wird, um die Absichten des Treugebers widerzuspiegeln und dem Recht von Guernsey zu entsprechen.

- Ernennung des Treuhänders: Der Treuhänder kann ein professioneller Unternehmenstreuhänder sein, wie z. B. der Unternehmenstreuhänder von Dixcart Guernsey, oder eine Privatperson. Es ist von entscheidender Bedeutung, dass der Treuhänder in der Lage ist, das Treuhandvermögen zu verwalten und seinen treuhänderischen Pflichten nachzukommen.

- Übertragung von Vermögenswerten an der Treuhandgesellschaft: Nach der Gründung des Trusts überträgt der Treugeber Vermögenswerte an der Treuhandgesellschaft. Zu diesen Vermögenswerten können Bargeld, Investitionen, Immobilien, Kunstwerke, Yachten oder Unternehmensanteile gehören. Der Treuhänder übernimmt dann das rechtliche Eigentum an diesen Vermögenswerten und verwaltet sie im Namen der Begünstigten.

- Laufende Verwaltung: Treuhandvermögen erfordern eine laufende Verwaltung, einschließlich der Führung von Aufzeichnungen, Berichterstattung, Buchhaltung, Ausschüttungen an Begünstigte und Sicherstellung der Einhaltung aller rechtlichen oder steuerlichen Verpflichtungen. Bei Dixcart Guernsey bieten wir umfassende Treuhandverwaltungsdienste an, um sicherzustellen, dass der Treuhandfonds reibungslos und in Übereinstimmung mit allen geltenden Gesetzen funktioniert.

Warum Dixcart Guernsey wählen?

Dixcart ist stolz darauf, seit seiner Gründung im Jahr 1972 in Familienbesitz zu sein, wobei die vierte Generation der Familie im Jahr 2023 in die Gruppe eingetreten ist. Mit jahrzehntelanger Erfahrung im Trust-Sektor bietet Dixcart Guernsey fachkundige Beratung und maßgeschneiderte Lösungen für die Einrichtung und Verwaltung von Trust-Strukturen. Unser Team setzt sich dafür ein, dass jeder Trust im besten Interesse der Begünstigten verwaltet wird und gleichzeitig die Wünsche des Treugebers erfüllt werden. Wir sind stolz darauf, einen persönlichen und maßgeschneiderten Service zu bieten, der den höchsten Standards in Bezug auf Professionalität, Vertraulichkeit und Freundlichkeit entspricht.

Die Trust-Strukturen von Guernsey bieten einen vielseitigen und soliden Rahmen für die Verwaltung und den Schutz von Vermögen. Ganz gleich, ob Sie die finanzielle Zukunft Ihrer Familie sichern, Ihr Vermögen schützen oder Ihre Nachfolge planen möchten, Dixcart Guernsey steht Ihnen bei jedem Schritt des Prozesses zur Seite.

Kontaktieren Sie uns

Kontaktieren unter advice.guernsey@dixcart.com, um mehr darüber zu erfahren, wie wir Sie bei der Einrichtung einer Treuhandgesellschaft unterstützen können, der Ihren individuellen Bedürfnissen entspricht, oder wenn Sie daran interessiert sind, den Dienstleister für eine bestehende Struktur zu wechseln.

Diese Mitteilung soll zwar Informationen über die Strukturen von Guernsey Treuhandgesellschaft und Beispiele für deren Einsatzmöglichkeiten bieten, stellt jedoch keine Rechts- oder Steuerberatung dar. Wir empfehlen allen Personen, die die Einrichtung einer Vermögensplanungsstruktur in Erwägung ziehen, sich zuvor von unabhängigen Rechts- und Steuerberatern beraten zu lassen.

Dixcart Trust Corporation Limited, Guernsey: Vollständige Treuhandlizenz, erteilt von der Guernsey Financial Services Commission.

Dixcart Fund Administrators (Guernsey) Limited: Lizenz zum Schutz von Investoren, erteilt von der Guernsey Financial Services Commission.