Pre Initial Public Offering (IPO) Planning and Trusts

Trust structures are generally associated with estate and succession planning for private client engagements, because of the advantages and safeguards that a well-structured trust can provide. Trusts, however, can also play an important role within corporate transactions. Consider initial public offering (IPO) planning and Trusts, for the major shareholders (founders) of a company, that are looking to take their company public.

Use of a Trust as Part of Corporate Processes

Careful pre-IPO Trust planning can provide the founders with a number of benefits in respect of their shareholding in the company to be listed (‘List Co’), and may also be used to create employee incentive schemes to reward, motivate and retain employees during and after the IPO process.

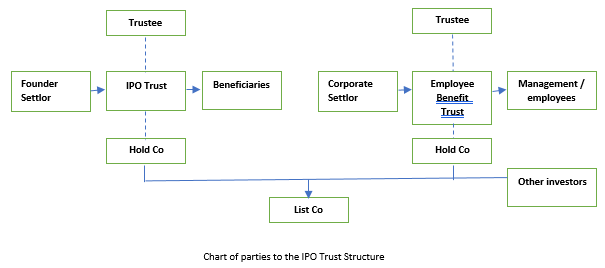

Chart of Parties Involved in an IPO Trust Structure:

Founders, the Family and an IPO Trust

Whether the founders are considering a company listing to generate capital or alternatively as an exit strategy, family circumstances are often overlooked, and these can play a pivotal role in the success of a listing.

Before the List Co is listed, it is often the case that the company founder owns a substantial holding of the shares in the List Co through a holding company (Hold Co). By creating a pre-IPO Trust, the founder can transfer all of his/her shares in the Hold Co to the Trustee, and the Trustee then indirectly holds shares in the List Co though the Hold Co, for the benefit of the beneficiaries of the Trust.

Purpose and Benefits

A pre-IPO Trust provides a wide range of benefits, including:

– continuing security without the distraction of hostile bidders, activist shareholders or adverse media;

– risk impact protection (potential mitigation from adverse events such as divorce, incapacity or death);

– concentrated shareholding remains under the control of the Trustee, in the event of the death of the founder. This is compared to the potential dilution of holdings to several family members though the administration of the estate after death;

– family wealth and succession planning;

– potential mitigation of probate costs and issues;

– privacy, irrespective of the number of family members or changes from one generation of beneficiaries to the next;

– potential tax mitigation depending on the jurisdiction of the Trust, the situs of the assets held and the residence and domicile of the beneficiaries.

Employee Benefit IPO Trusts (EBT)

Another important aspect of trust arrangements in IPO planning is the establishment of a trust for the benefit of employees. Although employee benefit or incentive structures can be designed in a variety of ways, many of them are provided through discretionary trusts.

Where the company establishing the structure and settling the assets into the Trust is the settlor, the beneficiaries of the trust may comprise current and future employees of the settlor company.

The rationale for establishing an EBT as part of the IPO process is to hold shares in the newly listed entity and for those shares to subsequently be used to provide efficient incentives for staff.

Purpose and Benefits in relation to Staff

The benefits of establishing an EBT include:

– hold founding IPO stake for the benefit of the management;

– short, medium and long term buy-in and incentivisation of key staff;

– opportunity to offer stakeholder incentivisation to a wide staff base;

– potential protection from the demands of creditors, in the event of a liquidation.

Governing Law of the IPO Trust

When choosing the governing law for the trust, consideration should be given to a jurisdiction which is politically stable and has a well-established legal system, sophisticated and modern trust legislation and offers a low tax regime.

The jurisdiction of Guernsey fulfils these criteria and would be a sound choice for the establishment of pre-IPO Trusts.

Choice of Trustee

The trustee has responsibility for administering the Trust and determining the amount and timing of distributions, in accordance with the terms of the Trust Deed. Selecting a capable and experienced Trustee is therefore critical.

Why Choose Dixcart in Guernsey as Trustee?

Dixcart Trust Corporation Limited (“Dixcart”), has over 45 years of expertise and experience in the provision of professional trustee and corporate management services.

Dixcart can provide both listing support services and outsourced professional company secretarial services for listed companies and are in a position to assist with supporting both the wider pre and post-IPO processes.

The Dixcart Group remains privately owned and fully independent. Clients benefit from long-term continuity and stability of relationships, and high standards of professional care.

Further Information

For further information on this subject please contact the Dixcart office in Guernsey: advice.guernsey@dixcart.com, or your usual Dixcart contact.

Dixcart Trust Corporation Limited, Guernsey: Full Fiduciary Licence granted by the Guernsey Financial Services Commission. Guernsey registered company number: 6512.