Private Trust Foundation Structure: A Tailored Solution for Middle Eastern High Net Worth Families

The Middle East is home to a growing number of high-net-worth families with diverse and often complex wealth management and estate and succession planning needs. As families in the region focus on preserving their legacies and planning for the next generation, innovative structures like the Private Trust Foundation (PTF) offer an ideal solution. Combining the best aspects of Guernsey Trusts and Foundations, a PTF provides a tailored approach to managing and safeguarding wealth in alignment with the region’s unique cultural, financial, and legal considerations.

What is a Private Trust Foundation?

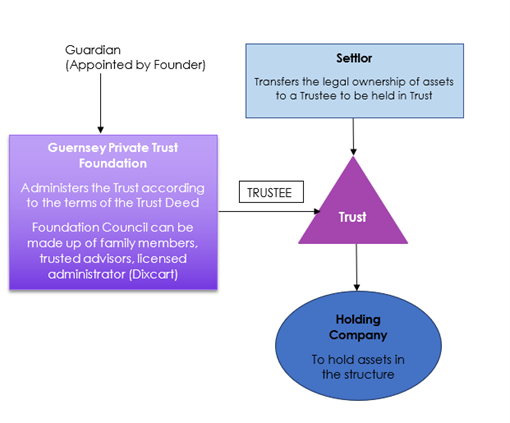

A Private Trust Foundation is a hybrid structure where a Guernsey Foundation acts as the trustee for a Guernsey Trust. This innovative arrangement combines the flexibility, confidentiality, and tax efficiency of a trust with the legal personality, governance, and control offered by a foundation.

For Middle Eastern families, this structure provides a robust mechanism to align with Sharia-compliant principles, address succession challenges, and centralise asset management, whilst maintaining privacy and often most importantly for our clients, control.

In this arrangement:

- The Foundation serves as the trustee, holding legal ownership of the trust assets and managing them according to the Trust Deed. This could include holding shares in the family business.

- The Trust retains its role as a fiduciary vehicle to protect and distribute wealth in line with the settlor’s wishes via the Trust Deed.

- A Guardian is appointed by the Founder of the Foundation to ensure the Foundation Council acts in accordance with the Foundation’s objectives and charter.

- The Settlor transfers the legal ownership of assets to be held by the Trust in accordance with the Trust Deed.

- Beneficiaries are appointed by the Settlor within the Trust Deed detailing whom the structure should benefit. The Settlor may also be a beneficiary.

- The Foundation Council can be made up of family members, working alongside professional fiduciaries to ensure decisions reflect both family values and professional expertise.

- In order to benefit from the Guernsey regulatory regime either the Guardian of the Foundation or one of the Council members must be a licensed Corporate Service Provider in Guernsey

The Appeal of Private Trust Foundations to Middle Eastern Clients

- Succession Planning Across Generations

Many Middle Eastern families operate multigenerational businesses or hold significant wealth across jurisdictions. A PTF ensures seamless wealth transfer, providing a clear and controlled framework for succession planning. The foundation’s governance allows for family representation while adhering to the settlor’s vision. - Sharia Compliance and Family Harmony

Islamic principles, such as the equitable distribution of wealth and asset preservation, can be accommodated within the flexible structure of a PTF. The foundation’s role as trustee ensures that the trust is managed according to specific family or religious requirements, reducing potential disputes and fostering unity. - Privacy and Confidentiality

Discretion is paramount for many families in the Middle East. Guernsey offers a high degree of confidentiality, with no public register of trusts and the register of foundations only includes the following information; foundation name, registered office address, registration date and foundation status. . This ensures that details about the Settlor / Founder, beneficiaries, assets, and governance remain private. - Centralised Control and Governance

The foundation’s council acts as a decision-making body, balancing professional expertise with family involvement. This structure aligns with the preference for centralised control often seen in Middle Eastern family enterprises. - Protection Against External Risks

Political or economic instability can pose risks to family wealth. The PTF structure provides a stable, legally robust framework to protect assets from external claims or unforeseen challenges. - Adaptability

Whether for holding shares in a family business, preserving real estate, or facilitating philanthropic endeavours, the PTF adapts to the family’s unique needs.

Real-World Applications for Middle Eastern Clients

- Business Succession Planning

Many Middle Eastern families rely on family businesses as their primary source of wealth. A PTF allows for professional management while preserving family control. It can hold business shares and ensure continuity through generations. - Asset Protection

In jurisdictions with uncertain political or legal environments, a PTF offers security and stability. Wealth is managed under Guernsey’s strong legal framework, reducing exposure to local risks. - Philanthropy and Religious Giving

A PTF can be used to structure charitable giving or fulfil zakat obligations through the Trust in a transparent and compliant manner. The foundation’s oversight and control of the Trust ensures that philanthropic objectives are met appropriately. - Multi-Jurisdictional Asset Management

For families with assets across the globe, the PTF provides a centralised structure, simplifying management whilst respecting local regulations.

Why Choose Guernsey?

- Global Reputation: Guernsey is renowned for its stability, expertise, and innovation in fiduciary and wealth structuring. Its legal framework ensures that structures like PTFs meet international standards while offering flexibility.

- Favourable Tax Environment: Guernsey’s tax-neutral regime benefits Middle Eastern families by enhancing tax efficiency without compromising compliance.

- Expertise: Service providers in Guernsey, such as Dixcart, bring decades of experience in tailoring solutions to clients with complex needs, ensuring a seamless and professional experience.

Conclusion

A Private Trust Foundation is a modern, adaptable solution for Middle Eastern high-net-worth families seeking to preserve wealth, plan for succession, and uphold cultural values. Its unique combination of trust and foundation benefits ensures privacy, protection, and a legacy that aligns with your family’s vision.

At Dixcart Guernsey, we specialise in crafting bespoke wealth management solutions tailored to your specific circumstances. Contact the Dixcart office in Guernsey at advice.guernsey@dixcart.com to discuss how a Private Trust Foundation could meet your family’s unique needs.