Proposal for Greater Transparency of ‘Shell’ Entities in the EU

The Unshell Bill

The European Commission met on 22 December 2021 in Brussels, to discuss the Unshell Bill, the so called anti-tax avoidance Directive 3 (“ATAD 3”), to address the misuse of “shell”, or letterbox, companies that have been created for improper tax purposes.

The purpose is to discourage the use of “shell” companies, where there is little or no business activity, and/or where the vehicle is being used for aggressive tax planning or tax avoidance and evasion purposes. It will mean that in the future, deemed shell companies will not be able to access tax relief and related benefits, if certain criteria are met. The proposal is relevant to all businesses; small, medium and large.

The Misuse of Shell Companies

The misuse of shell companies exists in various forms and presents an opportunity to abuse tax obligations.

Shell companies are typically created to generate a financial flow through the respective company, in jurisdictions with no or very low taxes or where taxes are circumvented in some way. In other cases, individuals make use of shell companies to shield assets and real estate from taxes, either in the country in which they are resident or where the property is physically located.

Key Components of the Bill

The proposed Directive, once adopted, must be transposed into national law by the Member States before 30 June 2023, to come into effect from 1 January 2024.

This Directive sets out transparency standards, so that entities that merely exist ‘on paper’ can be more easily detected by the respective tax authorities.

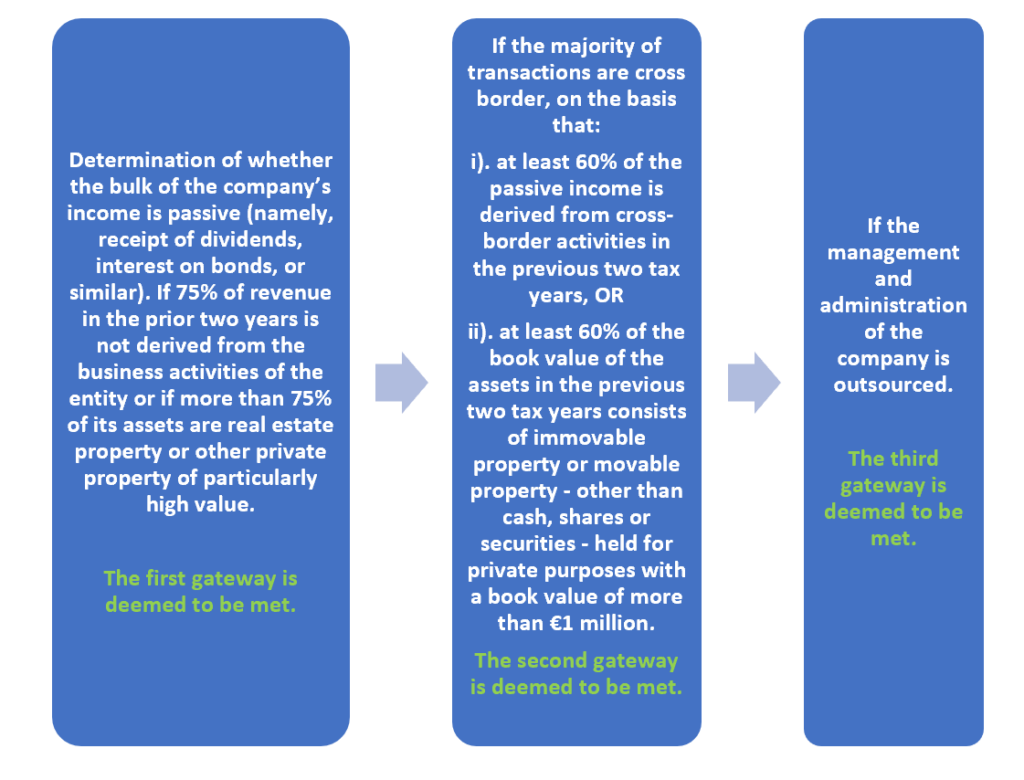

The EU Commission proposes to introduce a filtering system to determine whether a company is deemed to be a shell company or not.

Companies that meet three gateway ‘cumulative’ requirements, will need to disclose information in their tax return to validate the company’s substance. This information will include providing supporting evidence regarding the company’s premises and bank accounts as well as the tax residency of its directors and employees.

The Indicators or Gateways

The key indicators or gateways are highlighted below:

Consequences of Gateways Being Met

If all three gateway specifications, as detailed above, are met, and there is a subsequent failure to meet the substance validation requirements, from the information provided in the relevant tax return, the company will be deemed a shell company and will not be able to access tax relief and any related benefits.

In addition, companies will not be able to obtain a tax residency certificate or will receive a certificate to say that it is a “shell”. The “shell” entity will be regarded as a “flow entity” and thus any payments to third countries, for example, will not be treated as flowing through the “shell” entity. Withholding tax will be applicable in the state of the “shell’s” shareholder/s.

Opportunity to ‘Appeal’

It is worth noting that companies will be able to rebut the presumption of shell status, through the submission of additional evidence. This information is likely to include additional data relating to the non-tax reason/s for its existence, as well as other additional evidence that is considered valid.

Sharing of Information

Member State authorities will automatically share information, regardless of whether companies are deemed to be a shell or not.

In addition, one EU Member State may require another EU Member State to carry out a tax audit for a company that is deemed to have shell company characteristics.

Penalties

In addition to the penalties that will be imposed and defined by the individual Member State(s), a penalty payment of at least 5% of the turnover of the company in the relevant tax year, will be imposed, for failure to comply with the notification obligations and/or false declarations on the tax return.

Summary

The introduction of this proposal will; provide more transparency among Member States, will ensure that shell companies have legitimate reasons for their existence, and will ensure a more even playing field for European businesses.

Dixcart Compliance Advice and Further Information

Dixcart professionals in the Dixcart Portugal office, as well as in our other Dixcart offices are fully conversant with this draft EU Directive.

We can provide detailed advice regarding transparency and compliance to our clients. If you require additional information, please contact Lionel de Freitas or Monica Santos at the Dixcart office in Portugal: advice.portugal@dixcart.com.