The Cyprus Company and Notional Interest Deduction (NID)

With effect from 1 January 2015, Cyprus tax resident companies and Cyprus permanent establishments (PEs) of non-Cyprus tax resident companies are entitled to a Notional Interest Deduction (NID) upon the contribution of New Equity employed in the production of taxable income. The new equity can be introduced in the form of paid-up share capital or share premium.

The NID was introduced mainly to harmonise the equity financing tax treatment with the debt financing tax treatment and to promote the capital- incentive investment in Cyprus. The NID is deductible in the same manner as for actual interest expense, but it does not trigger any accounting entries since it is a “notional” deduction.

The deduction is calculated as a percentage (reference rate) on the new equity. The relevant reference rate is the yield of the 10-year government bond (as of December 31 of the previous tax year) of the country where the funds (the new equity) are invested in the business of the company, plus a 5% premium.

If the country where the new equity is employed lacks a 10-year government bond issued by December 31 of the relevant year, the reference rate will be the Cyprus government 10-year bond rate plus a 5% premium.

The NID is deducted from the taxable income of a company for as long as the new equity financing is used in its operations and produces taxable income. The deduction is subject to a number of conditions, including an 80% taxable-income limitation.

On March 7, 2024, the Cyprus Tax Department published the bond yield rates as of December 31, 2023, for a number of countries. These rates are to be used for the Notional Interest Deduction (NID) applicable to equity injected into Cyprus companies for 2024.

| 31/12/2023 | NID Reference Interest Rate 2024 | |

| Cyprus | 3.25% | 8.25% |

Anti avoidance rules

A number of anti-avoidance provisions are included in the legislation, in order to ensure that there is no abuse of the new benefit granted, such us ‘’dressing up’’ old capital into new capital, claiming notional interest twice on the same funds through the use of multiple companies or where the arrangements introduce lack valid economic or commercial reasons.

The Commissioner may not authorize the granting of any allowance under the NID provisions, if he considers that actions or transactions have taken place without substantial economic or commercial purpose.

Example

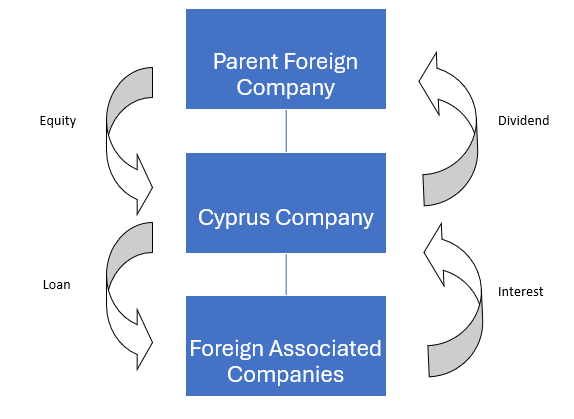

A parent foreign company introduces equity in its Cyprus subsidiary and the Cyprus company used the equity to finance other associated foreign companies.

New equity introduced: €10m

Loans advanced: €10m

Interest rate charged: 10.00%

Cyprus 10-year government bond rate: 3.25 %

Income Tax at Cyprus Level

Interest / Taxable income: €10m*10% = €1.000.000

Notional interest deduction:

Lower of (3.25%+5%)*€10m = €825.000 and 80%* €1.000.000 = €800.000

Thus:

| Taxable Income: | €1.000.0000 |

| Notional Interest deduction: | (€800.000) |

| Net taxable income: | €200.000 |

| Corporation tax @ 12.5% | €25.000 |

| Effective tax rate: | 2.50% |