An Introduction to Isle of Man Foundations for Offshore Planning (1 of 3)

Whilst Isle of Man Trusts and Isle of Man Limited Companies have been mainstays of offshore wealth planning for decades, the relatively recent introduction of the Isle of Man Foundation in 2011 has provided advisers with a blend of features possessed by corporate entities and fiduciary vehicles, to further their clients’ objectives.

Having been the preferred choice of our Civil Law counterparts for centuries, a Foundation offers objectivity and operational structure without compromising on flexibility, where discretion is concerned.

This is the first in a three part series we have produced on Foundations, building up to a webinar hosted by experts who can help you to meet your clients’ needs. If you would like to read the other articles in this series, please see:

- Establishing and Administering an Isle of Man Foundation (2 of 3)

- When to use an Isle of Man Foundation (3 of 3)

In this introductory article, we will discuss the rudimentary aspects of Foundations, to aid or refresh your understanding:

- What is an Isle of Man Foundation?

- Foundation vs Trust vs Limited Company

- What is an Isle of Man Foundation used for?

- Supporting the Establishment & Administration of Foundations

What is an Isle of Man Foundation?

An Isle of Man Foundation is established and regulated under the Foundations Act 2011, and registered on the Isle of Man. The Act has added the Civil Law entity to the toolbelt of advisers seeking to provide offshore services from a well-established international financial centre.

The blended approach that Foundations offer is unique, with features that make them distinct from more familiar structures such as Limited Companies or Trusts.

The next article in this series will take a dive into the technicalities of all aspects of this vehicle, but for now we have just provided a brief overview of the constituent elements that you need to be aware of:

- Founder – The person who initially instructed the establishment and agreed the objects of the foundation.

- Dedicators – Anyone other than the Founder that dedicates assets to the Foundation.

- Official Documents – There are two official documents, the Foundation Instrument and the Foundation Rules, which set out the details relating to the administration of the foundation and the rights and obligations of the persons appointed under the rules.

- Objects – Specified in the Foundation Instrument, these detail the specific purpose and objectives of the Foundation.

- Council – Comprised of one or more members, the Council carries out the administration of the Foundation in accordance with the Official Documents.

- Registered Agent – All Foundations must have a Registered Agent licensed by the Isle of Man Financial Services Authority. You can find more information on Isle of Man Registered Agents here.

- Enforcer – If an object of a foundation is to carry out a non-charitable purpose, the foundation must have an Enforcer. This person ensures that the Council operate in line with the Official Documents and in the best interests of the Foundation.

- Beneficiary – The party that can benefit from the Foundation.

Foundation vs Trust vs Limited Company

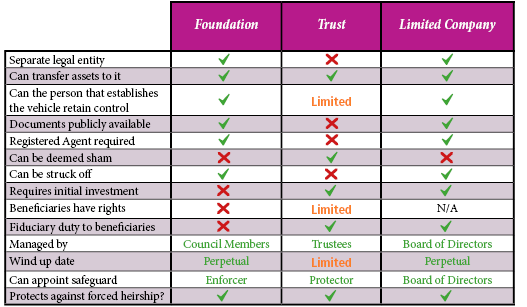

The table below compares and contrasts the features of Isle of Man Foundations, Trusts, and Limited Companies and may be helpful to determine the most appropriate vehicle to achieve the desired objectives.

Whilst Foundations cannot conduct commercial trade directly, other than trade relating to the Objects, it can hold subsidiary companies which can in turn be used for commercial transactions.

As you can see from the table, both a Foundation and a Trust can be used in very similar circumstances, to benefit successive generations or charitable initiatives. The main differences relate to the flexibility in making operational changes (e.g. appointment and removal of Council Members / Trustees and/or editing the constitutional documents), liability of the managers (i.e. legal action is against the Foundation rather than its Council Members), perpetuity and winding up – each offering discretion or choice in certain areas, which can make it better suited to the client’s needs.

Ultimately, a Foundation provides a living structure that can be reactive and adaptable to changing needs, where provided for, in the Official Documents. Something that can be more limiting when using a Trust structure.

Of course, Foundations can also be used in conjunction with trusts to provide some of the benefits of a trust combined with those of a corporate entity – e.g. diversified interests, to act as trustee and to provide additional oversight and transparency; which might make institutional transactions more attractive.

What is an Isle of Man Foundation used for?

A Foundation holds and owns assets, typically provided for specific purpose; for example, to benefit family members or philanthropic endeavours. With this in mind, uses of Isle of Man Foundations can include:

- A familiar alternative to trusts for clients from Civil Law jurisdictions;

- A legal entity for succession planning or philanthropic pursuits;

- A wealth planning vehicle to hold assets (e.g. private company shares, yachts, aircraft);

- Use in conjunction with a Trust to provide additional structure and oversight;

Supporting the Establishment and Administration of Foundations

At Dixcart, we offer a full suite of offshore services to advisers and their clients when considering the establishment of an Isle of Man Foundation. Our in-house experts are professionally qualified, with a wealth of experience; this means we are well placed to support and take responsibility for different roles, including acting as Registered Agent, Council Member or Enforcer as well as providing specialist advice, where appropriate.

From pre-application planning and advice, to the day-to-day administration of the Foundation, we can support your goals at every stage.

Get in touch

If you require further information regarding Isle of Man Foundations, their establishment or management, please feel free to get in touch with Steve Doyle at Dixcart: advice.iom@dixcart.com

Alternatively, you can connect with Steve on LinkedIn

Dixcart Management (IOM) Limited is licensed by the Isle of Man Financial Services Authority.