We have now had an extended period in which world markets have been shaken by international events. For example, the value of the British Pound (£GBP) has been depressed (albeit showing signs of recovery due to Bond market performance) owing to a blend of home grown and global economic forces (Brexit, pandemic, war, inflation et al). But in this fiscal adversity lies a potentially lucrative opportunity.

It may be an opportune time for those based in the world’s more buoyant economies to look to international investment, monopolising on weakened currencies, undervalued markets, and any differences in interest rates etc. But for many with the resources to undertake such activity, such as Family Offices, Private Equity Funds or even HNWIs with significant assets, the question of how best to leverage this advantage can be complex and unwieldly, even resulting in decision-making paralysis – worse, this inertia could even lead to missing the boat altogether.

At Dixcart, we work with a wide range of professionals to deliver solutions for such clients. In this article we consider how you and your advisers could utilise an Isle of Man Special Purpose Vehicle (SPV) to unlock your next international investment opportunity:

- Why is the Isle of Man a Good Choice for Your Special Purpose Vehicle?

- Which Isle of Man Entities are Available to Act as Special Purpose Vehicles?

- Leveraging Against Your Existing Portfolio

- What Loan Facilities are Available to an Isle of Man Special Purpose Vehicle?

- How Could an Offshore SPV be Used for International Investment?

- How Can Dixcart Assist with Your Next International Investment?

1. Why is the Isle of Man a Good Choice for Your Special Purpose Vehicle?

Typically, an offshore SPV will be utilised to ringfence assets and liabilities in relation to a given activity or objective, thus mitigating risk. For example, to purchase an equity position in a company, to conduct mergers and acquisitions, provide angel investment to a start-up, securitisation of debt, raising additional capital, purchasing luxury assets etc. Structuring your investment vehicle in this way can have the broad effect of:

- Protection against insolvency via ringfencing the assets and liabilities of the Beneficial Owner and SPV.

- There may be no audit requirements where the SPV is below the earnings threshold.

- Providing commercial privacy, dependent on the local regime e.g. there is no requirement for accounts to be made publicly available in the Isle of Man.

- Can shield the SPV from legal action taken against the Beneficial Owners and vice versa.

- Providing legal and tax certainty dependent on the jurisdiction of establishment.

- And more…

Further to this, several features make the Isle of Man an attractive prospect for incorporating your SPV when undertaking international investment:

Tax Regime

The Isle of Man has a favourable tax regime for corporate entities, which makes it an attractive location for incorporating SPVs geared towards investment. Famously the island benefits from the following headline rates:

- 0% Corporate Tax

- 0% Capital Gains Tax

- 0% tax on most Dividends and Interest payments

Further, the Isle of Man falls under the UK’s VAT regime, which can be beneficial in certain circumstances. Isle of Man Entities can register for VAT purposes, and benefit from service providers’ experience in this regime and a more responsive VAT Office generally.

However, it is important to note that there may be tax payable in the local jurisdiction where the activity is taking place depending on the nature of the proposed activity and the local tax rules. This is a complex area, and it is vital to engage an appropriate tax adviser when conducting such planning. Dixcart have a wide range of professional contacts and can make introductions as desired.

Legal Regime

The Isle of Man has modern and flexible corporate laws that allow for the creation of various types of SPV. The legislative environment is also politically agnostic, and therefore stable and reliable. The flexibility offered, allows SPVs to tailor their structures to meet their specific objectives, whilst the enduring nature of the legal regime provides certainty.

Additionally, whilst UK Case Law is persuasive, Manx Law is distinct and will only follow the Precedents of the Courts of England & Wales, in the absence of Manx authority. Further, foreign Court Orders are not directly enforceable without an equivalent Manx Court Order. As the Courts and laws of the Isle of Man are tailored to its requirements, it is particularly well placed to deal with matters relating to Company Law, Trust Law, and Tax etc.

In addition, lenders can take comfort as registered legal charges are publicly available on the Isle of Man Companies Registry search. For example, this is a requirement for companies formed under the Companies Act 1931. Therefore, details regarding all existing registered charges are available to the lender online, on-demand.

Global Standing

The Isle of Man is OECD ‘Whitelisted’ and therefore regarded as a well-run financial centre. The island has a global reputation for being a well-regulated jurisdiction with a stable political and economic environment. The Isle of Man Financial Services Authority has a proactive approach to regulating financial services, ensuring good governance, which provides investors and lenders with confidence in the enterprise. This can make activities such as debt financing more attractive to lenders, as the Isle of Man is easy to do business with.

Regulated Professional Services

The Isle of Man has a heritage in international planning and offers a well-developed financial services industry, including highly experienced service providers, such as Dixcart, who can assist with the setup and ongoing management of SPVs. Further, the investor and lender can take comfort from the fact that Isle of Man corporate service providers must possess a license and are regulated, unlike their UK counterparts.

Proximity

The Isle of Man is located in the middle of the Irish Sea, between the UK and Ireland, making it easily accessible from both locations. But more importantly, operates in the same time zone as the UK and is just +1 CET for European activities. This proximity makes it a convenient location for individuals and companies looking to set up SPVs for access to markets in similar time zones, such as the UK or other European jurisdictions.

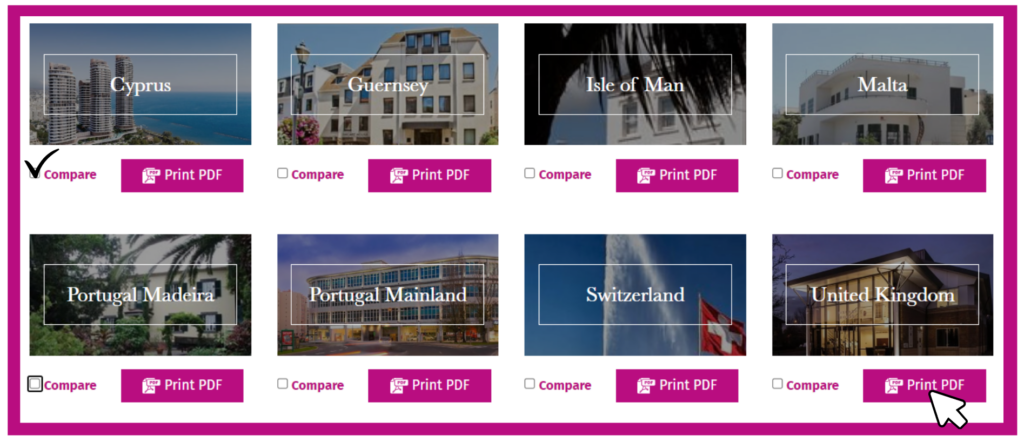

2. Which Isle of Man Entities Are Available to Act As Special Purpose Vehicles?

The Isle of Man offers a wide variety of vehicles to act as SPVs and undertake investment via debt or equity financing. A corporate entity can be incorporated on the island in 48 hours or less for a minimum Registry fee of £100 – quicker times are available for increased Government fees. It is important to note that the incorporation fee does not include the service provider’s onboarding fee.

Appropriate entities include:

Isle of Man Companies Act 2006 Company

The Isle of Man Companies Act 2006 (CA 2006) Company is a modern corporate vehicle that has a great deal of flexibility when compared to a more traditional Companies Act 1931 Company.

There are no thin capitalisation rules on a CA 2006 Co as the company may be incorporated with a single share, which can have a par value of zero. The CA 2006 Co simply requires a Registered Office, Registered Agent and a minimum of one Shareholder and one Director. The Director can be a non-Isle of Man Resident, and Corporate Directors are permitted. No Company Secretary is required.

All charges are deemed to be registerable under the CA 2006 and charges should be registered within 1 month of creation. The CA 2006 provides additional flexibility in this regard, as charges can be registered after this 1-month period. In reality the registration of such a charge will likely be a term of the Loan Agreement and as an SPV, the company is unlikely to have existing charges or trade debts etc.

Limited Partnership with Separate Legal Personality

As stipulated in the Isle of Man Partnership Act 1909, Limited Partnerships require a minimum of two Partners, made up of one or more General Partners (GP) and one or more Limited Partners (LP). A minimum of one Partner must be Isle of Man Resident.

A GP has unlimited liability and is free to engage in the day-to day management of the Limited Partnership i.e. administer the investment(s). The GP can be a Corporate entity. Due to this uncapped liability, the GP is typically an Isle of Man Limited Company.

The LP would be the investor, whose liability is fixed at outset and restricted to the capital or property contributed or outstanding. Conversely, the LP cannot engage in the day-to-day administration of the Partnership, lest they be deemed a GP and therefore be exposed to unlimited liability.

Further, under the Limited Partnership (Legal Personality) Act 2011, the Limited Partnership can be incorporated with separate legal personality, thereby being capable of contracting and being a party to legal action.

The Limited Partnership is a transparent entity for tax purposes and therefore Gains are realised on the Partner’s personal rates of taxation (e.g. income tax, Inheritance Tax etc.).

Protected Cell Company (PCC)

A Protected Cell Company (PCC) operates as an independent legal entity, equipped with the authority to engage in contracts, assume ownership of assets, and be subject to legal action. The structure of a PCC allows for the creation of an unlimited number of separate Cells. Each of these Cells serves as a compartmentalised unit with its own assets and liabilities, which are distinctly isolated from those of the other Cells and the PCC’s non-cellular assets and liabilities.

Alongside the non-cellular ordinary shares of the PCC, cellular shares can also be issued. The holder of these cellular shares is permitted to participate in the activities of the specific Cell they invest in, with rights outlined by the Articles of Association.

Accounting transparency is ensured by requiring a separate set of accounts and a tax return for each Cell. Moreover, each Cell must be clearly identifiable as part of a PCC, and all third parties transacting with a Cell must be aware of its status within a PCC structure.

The PCC model presents a valuable strategy for a Beneficial Owner aiming to delineate different activities and associated risks. For instance, one might isolate borrowing and financed activities conducted in one Cell from the private investment carried out in another. When a corporate investor such as a venture capital fund engages in multi-jurisdictional activities, like investing in startups, the Cells act as tangible barriers, segregating each business’s activities. They could also be tailored to reach maturity at varying dates, providing added flexibility.

Honourable Mentions

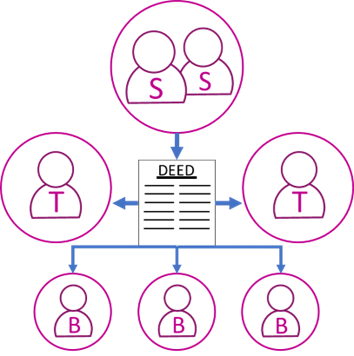

There are of course many more legal structures available to act as SPV, including; Limited Liability Companies, Foundations and Isle of Man Purpose Trusts. Each has distinct features that can make it appropriate in the correct context.

Economic Substance Considerations

It is important to note that there are rules around Economic Substance in the Isle of Man and Channel Islands. Incorporated entities in these jurisdictions, that undertake Relevant Sector Activity, will have to meet certain requirements to demonstrate the Core Income Generating Activity (CIGA) of the company occurs within the jurisdiction (Isle of Man or Channel Islands), to be Tax Resident. CIGA includes activity such as the entity being directed and managed in the jurisdiction, possessing an adequate and proportionate number of qualified employees (or working hours taking place) in the jurisdiction, possessing an adequate physical presence etc.

For example, if a corporate entity’s sole function is to acquire and hold equities, and the equities in question are controlling stakes in other companies, it is defined as a Pure Equity Holding Company for the purposes of Economic Substance. If the Pure Equity Holding Company derives income from this activity, it will have to demonstrate CIGA. This is accomplished via the provision of Directors, various management services and Registered Office on the Isle of Man or Channel Islands.

You can find the Isle of Man and Channel Islands guidance note on Economic Substance here.

3. Leveraging Against Your Existing Portfolio

As noted in the introduction, markets are tough at the moment and for those with money tied up in their portfolio, liquidating may not be in their best interests e.g. it may compound any losses. Considering debt financing your next international investment can be a good solution under the correct circumstances, but how do you unlock the value in your existing portfolio without compromising growth?

In today’s world it is commonplace for investors to arrange asset-based financing against less conventional security. For example, loan arrangements such as Lombard lending provide a credit facility secured against the investor’s more liquid personal investments, such as equities, bonds, or funds. The methods of how such facilities operate are discussed briefly in section 4.

Further, having initially started in the USA, specialist lenders have started to emerge across the world who can consider more complex arrangements that take into account Illiquid, sticky, or intangible assets. Such assets often present a challenge to use as collateral for financing as they do not have a readily available market value like liquid assets. As such, lending against these non-traditional asset classes is now made possible via insurances contracts that provide a market value guarantee in the event of default.

Illiquid assets are somewhat more straightforward than sticky and intangible assets. Such arrangements may simply require the creation of a charge over the purchased asset being financed e.g. where an aircraft is being constructed, a charge may be created over the aircraft, thus allowing the lender to take lawful possession in the event of default. It is quite normal for the lender in such instances to also take security over other assets in the borrower’s portfolio, such as the Lombard-style arrangement noted earlier, providing the lender with additional certainty to protect against loss.

It is important to work with a specialist lender or professional adviser when attempting to use such assets as collateral to ensure that you are getting a fair and accurate valuation.

4. What Loan Facilities are Available to my Isle of Man Special Purpose Vehicle?

While the Special Purpose Vehicle (SPV) can raise funds through diverse methods like issuing debentures or debt notes, it has a plethora of other financial strategies at its disposal, including acquiring debt financing through banking institutions or other financial intermediaries. Even though numerous banks operate on the Isle of Man – such as Barclays, RBSI, HSBC, NatWest, and others – the Isle of Man entity is not confined to these financial institutions, and deals can be orchestrated with virtually any global lender, given they meet the necessary compliance standards. A multitude of loan facilities are available in these scenarios, but Carried Interest Facilities, Capital Call Facilities, Margin Loan Facilities, and notably, Net Asset Value (NAV) Facilities are some of the most prevalent.

NAV Facilities, in particular, have witnessed escalating popularity, especially amid the prevailing bearish market conditions, where Beneficial Owners might prefer to avoid liquidating their investments at a probable loss. But what are NAV Facilities?

Net Asset Value (NAV) Facilities

NAV Facilities are a form of secured loan, where the collateral consists of assets from an investment vehicle, like a Private Equity Fund, Hedge Fund, or an investment portfolio. They provide investors the means to borrow against their assets’ value without divesting their holdings. The extent of the loan facility is determined by the ‘Net Asset Value’, which is calculated as the total worth of the packaged assets, after deducting liabilities and debts.

Under these provisions, lenders typically extend a line of credit based on a certain proportion of the Net Asset Value. The loan amount hinges on the lender’s evaluation of the quality and liquidity of the underlying assets, as well as the cash flows and distributions that ascend to investors from those assets.

In most instances, the lender will obtain security over the relevant assets, such as shares in the Master Fund/Feeder Fund or the investment holding vehicle. However, the terms of NAV Facilities can greatly vary, depending on the lender, connected parties, any holding vehicle involved, and the nature of the underlying assets. Additionally, the interest rates could be fixed or variable, and the lender might reserve the right to seize the assets or compel a sale in case of an SPV loan default.

NAV Facilities afford investors easy access to liquidity without compelling them to offload their investments. This, in turn, enables them to leverage new investment prospects promptly, without impacting the compounded growth of their leveraged assets. The loan facility can also cover any ongoing or unforeseen expenses, like redemptions or legal fees, endowing the investment vehicle with an element of stability and resilience.

5. How Could an Offshore SPV be Used for International Investment?

Once the capital has been secured via private funding, loan arrangement etc. there are many ways in which an Isle of Man SPV may be utilised to achieve your financial objectives. Typically these include activities such as packaging assets as securitisation, engaging in structured finance, as an investment vehicle, purchasing a luxury asset etc.

Some of the most common uses we see are:

Investment Vehicle

Whilst an Isle of Man SPV can be used to structure open or closed ended investment vehicles for entities such as hedge funds, private equity funds, or venture capital funds undertaking international investment, simple investment companies are often used for private arrangements. The archetypal investment company will use the Isle of Man SPV to co-ordinate the investment capital from investors in multiple jurisdictions or who are looking to undertake investment activity in a foreign market. For example, the funds may come from Hong Kong, Singapore and any number of equivalent jurisdictions, into the Isle of Man SPV that then purchases the equity in a UK SPV undertaking the build and subsequent leasing or sale of UK Real estate, start-ups or growing businesses, with a view to receiving and accumulating Dividends paid to shareholders for reinvestment.

Purchasing a Luxury Asset

In almost every instance, where a client is seeking to acquire a prestigious asset, such as a yacht or jet, an SPV is the best method of purchase. The exact structuring will be guided by the tax and legal advice but will normally carry many benefits for the Beneficial Owner e.g. limiting liability / exposure, tax planning, potential VAT exemptions or recoverability etc. IOM SPVs are very attractive for those non-EU Tax Resident individuals utilising the craft for personal use, or in some circumstances a blend of personal use and commercial charter.Your Attractive HeadingYour Attractive Heading

You can read more about the various uses and features of Isle of Man Companies here.

6. How Can We Assist with Your Next International Investment?

Dixcart can assist with your international structuring, setting up and administering the offshore structures required by your planning. We work closely with clients and their advisers to ensure that the SPV is managed optimally, to facilitate your objectives.

The Dixcart Group has been delivering high quality offshore services to clients and their advisers for over 50 years, with the Isle of Man office trading since 1989. Over this time, we have developed strong working relationships with some of the world’s leading advisers – therefore, If you have not yet engaged a professional adviser, we can make an introduction as appropriate.

*Please note this information should not be considered financial advice, and we would recommend getting in touch with us via the details provided or discussing with your professional adviser before taking any action.

Get in Touch

If you require further information regarding the use of Offshore SPVs, or Isle of Man structures, please feel free to get in touch with Paul Harvey at Dixcart: advice.iom@dixcart.com

Dixcart Management (IOM) Limited is Licensed by the Isle of Man Financial Services Authority