Isle of Man companies provide a flexible vehicle that meet a huge variety of objectives and can be particularly beneficial under the right conditions.

Depending on the circumstances, the Ultimate Beneficial Owner (UBO) and their adviser can utilise Isle of Man companies in everything from corporate structuring and asset protection to wealth and estate planning. The Isle of Man company delivers a tax efficient and globally compliant solution.

In this article we highlight some of the good reasons to consider using Isle of Man companies:

Isle of Man Jurisdictional Benefits

The Isle of Man is an independent Crown Dependency that holds a Moody’s rating of Aa3 Negative, as at 28 October 2022, in line with the UK’s current rating. Companies registered in the Isle of Man benefit from the business-friendly Government, legislative environment and locally set tax regime. In addition, an Isle of Man company can be incorporated in 48 hours or less.

Headline rates of taxation include:

- 0% Corporate Tax

- 0% Capital Gains Tax

- 0% Inheritance Tax

- 0% Withholding Tax on Dividends

- Isle of Man companies are able to register for VAT, and businesses in the Isle of Man fall under the UK’s VAT regime.

However, the island offers more than just tax efficiency. It is OECD compliant and therefore not considered a tax haven and the local environment continues to provide world class professional services to those engaging in international wealth, corporate and estate planning.

You can read more about why the Isle of Man is a jurisdiction of choice, here.

The Flexibility of Isle of Man Companies

Isle of Man companies provide a large degree of flexibility in terms of their constitution and operation, particularly companies incorporated under CA 2006 – although, there can be situations where a more traditional CA 1931 company can be more attractive.

Whilst both types of company are required to maintain a Registered Office in the Isle of Man, must have a Nominated Officer etc. there is a large amount of freedom provided:

Companies Act 1931 | Companies Act 2006 |

No restrictions on trading objects |

Minimum of one Shareholder. Can be corporate. |

| Can have a single share, with no max. Share can hold a par value of as little as £0.01p. No thin capitalisation rules. Can be any currency. | Can have a single share, with no max. Share can hold a par value of zero. No thin capitalisation rules. Can be any currency. |

| Minimum of two Directors. Can be non-resident. Cannot be a corporate. | Minimum of one Director. Can be non-resident and can be a corporate. |

| Company Secretary required. Can be a non-resident and can be a Director. | Requires a Registered Agent at all times. Registered Agent is a licensed Isle of Man resident. |

Minimal restrictions on the management of dividends and share capital |

Requirement to produced Annual Financial Statements, in line with Part 1 of the Companies Act 1982.

Subject to meeting the conditions set out in the Companies (Audit Exemption) Regulations 2007, the Members can unanimously agree to dispense of the requirement for Annual Accounts to be audited where applicable. | No requirement to produce Annual Financial Statements, but it is standard practice to produce such accounts.

No requirement for Annual Accounts to be audited. |

Minimal filing and accounting requirements |

| There is a requirement to hold an Annual General Meeting, but private companies can dispense with this requirement in line with the Companies Act 1931 (Dispensation For Private Companies) (Annual General Meeting) Regulations 2010. | No requirement to hold Annual General Meetings. |

Furthermore, it is possible for a CA 1931 company to apply to re-register as a CA 2006 company and vice versa, since the commencement of the Companies (Amendment) Act 2021. This provides UBOs and advisers with ultimate flexibility with regards to the constitution of the company. You can read more about the effect of the Companies (Amendment) Act 2021 here.

You can read more about Isle of Man companies incorporated under the Companies Act 1931 here. Alternatively, you can read more about Isle of Man companies incorporated under the Companies Act 2006 here.

Dixcart have significant experience in assisting clients and their advisers with their corporate planning and can support them to make the most appropriate decisions regarding the choice of vehicle.

Isle of Man Companies and Disclosure of Beneficial Ownership

Central registers of beneficial ownership were introduced as a mandatory requirement for Member States and jurisdictions within the European Economic Area by Article 30 of the Fourth EU Money Laundering Directive (4MLD), coming into force in 2017. The Isle of Man gave affect to this Directive through the introduction of the Beneficial Ownership Act 2017.

Under the Beneficial Ownership Act 2017, where the UBO owns more than 25% of the legal entity the person is a Registrable Beneficial Owner, and the Nominated Officer must submit the Required Details to the Registrar to be held in the Isle of Man Database of Beneficial Ownership. The Register is not publicly available and is limited to competent Authorities and relevant organisations who conduct AML checks e.g. criminal enforcement bureaus such as the Financial Investigations Unit etc.

Further, you may be aware of a recent EU Court of Justice (CJEU) Grand Chamber ruling concerning the balancing the proportionality of achieving AML objectives and privacy rights. The judgement stemmed from a Luxembourg case, whereby a Luxembourg company and its UBO made an application to prevent information concerning beneficial ownership from being made publicly available – this was rejected by the Luxembourg RBO. Following this, the company and UBO began legal action relating to both the decision and legality of the legislative powers allowing this to take place.

The law gave affect to the Fifth EU Money Laundering Directive (5MLD). 5MLD amended Art 30 of 4MLD to make provision for any member of the general public to be entitled to access information concerning beneficial ownership. The Grand Chamber found that the legislation was indeed unlawful, and disproportionate in its derogation from the European Union’s Charter of Fundamental Rights – namely Art 7 the right to respect for private and family life, and Art 8 concerning the protection of personal data.

The Crown Dependencies’ financial regulators have released a joint statement in late December 2022 in response to this landmark CJEU Grand Chamber ruling. They intend to seek specialist legal advice regarding how to proceed in implementing 5MLD compliant legislation, given the outcome of the above case. The Crown Dependencies have stated that they intend to adopt legislation in their respective jurisdictions as soon as possible after receiving the expert legal opinion, which is expected to be completed in early 2023. Whilst the regulators are clearly committed to honouring their commitments to openness and transparency, the statement does not provide any consideration of how the judgement will affect any interpretation of 5MLD or the legality of introducing measures such as a public register. You can find the Joint Statement: Crown Dependencies on access to registers of beneficial ownership of companies here.

Redomiciling an Existing Company to the Isle of Man

If there is an existing legal entity, you may be able to redomicile it to the Isle of Man and reregister it under Companies Act 1931 or Companies Act 2006.

When an incorporated entity is redomiciled to the Isle of Man, the result is a continuation of the same body corporate with all of its assets, liabilities and obligations remaining i.e. it is not a new entity. However, once imported, the laws and regulations of the Isle of Man apply.

It is important to note that this process can only be undertaken if the jurisdiction that the legal entity is exiting has the required legislative framework in place. Of course, the Isle of Man possess such legislation. For example, conversely there is no such Statute in the UK to support redomiciliation, and therefore UK companies cannot be redomiciled to any jurisdiction.

Further, it is necessary for the UBO and/or adviser to be aware of the potential licensing requirements if they wish to continue certain business activities after redomiciliation.

Additionally, it is also necessary to ensure your company’s Registered Name, or a derivative is available – if available, it can be reserved. In such cases, we would advise contacting Dixcart in the first instance. For further information on choosing a company name, you can read the Company and Business Names Etc Act here and you can check the name’s availability here.

There is a myriad of reasons why a UBO or their adviser may seek to move their company to the Isle of Man. For example, where an entity has been incorporated in a jurisdiction that was previously attractive, but has since fallen out of favour, this can make administering the company operationally difficult owing to the implicit risks of that jurisdiction.

The Isle of Man is regarded as a compliant, stable and well-regulated jurisdiction, and is therefore considered a leading international destination for business. For example, due to the Isle of Man being well-regulated and transparent, those companies that wish to structure debt finance can be looked on favourably by banks, owing to facilities such as a public register of mortgages and other charges. You can read more about why the Isle of Man is a Preferred Jurisdiction for Corporate Structuring here.

Dixcart are well placed to assist with the redomiciliation of all incorporated vehicles.

Isle of Man Companies and Banking

From carrying out its activities to meeting its liabilities, reliable banking arrangements are essential. Where a company is not incorporated in a reputable jurisdiction, or worse a blacklisted jurisdiction, this can cause significant operational issues. Further, where the company does not bank with a trusted institution, this can also create operational issues.

The banks take a risk-based approach, considering various factors upon application e.g. jurisdictions, connected parties, source of funds and wealth, nature of activity, volume of transactions etc. all of which will influence the acceptability of the application. The resulting risk rating will also affect the level of fees payable to the bank.

In addition, high street banks will not provide services to Isle of Man companies that do not have a resident Director. Therefore, in the circumstances where the UBO and/or adviser do not wish Dixcart to provide Isle of Man Directors, other options will have to be considered – for example, do you have existing banking relationships within other jurisdictions?

Dixcart has good relationships with all of the banks on the Isle of Man and can facilitate banking services on fully managed entities. In circumstances where Dixcart are not providing Directors, we can make appropriate introductions.

Taxation of Isle of Man Companies

Tax advice is almost always essential for non-Isle of Man residents, when considering incorporating an Isle of Man company. There are so many factors at play – what activity is the company carrying out? Are there Economic Substance requirements to be met? How are foreign companies treated within the UBOs local jurisdiction? How involved can they be with the management and control of the company? Is the company conducting cross-border transactions? Etc.

Furthermore, as a compliant whitelisted jurisdiction, the Isle of Man has signed up to a number of information exchange and double-taxation agreements. There can be reporting requirements that must be taken into account.

As you can see, even considering these basic questions there are a lot of things to clarify, much of which can have complex tax implications and require professional advice. Generally, the place to start will be to take advice in the UBO’s local jurisdiction. Whilst our Isle of Man office does not provide tax advice, we have built up a network of contacts over our 30+ years of trading, and will be able to make an appropriate introduction to an adviser local to the UBO.

How Are Isle of Man Companies Used?

Isle of Man companies have a huge variety of uses, and can be an option in most circumstances where the planning allows for the use of the Isle of Man. Below, I have covered a number of areas where Isle of Man companies are commonly utilised.

Holding Companies

A large range of capital, from participations in other companies to investment portfolios and luxury assets, can benefit from being owned via an Isle of Man company, due to the local legislative environment and tax regime. In such situations it is particularly important to ensure that placing the assets with the Isle of Man company will not attract any unintended taxation or liabilities – this needs to be considered at outset. Often the question can be whether the cost of maintaining and administering an Isle of Man company will outweigh the benefits or vice versa.

Below I have noted some of the most common types of Isle of Man holding companies:

- Equity Holding: Isle of Man companies offer a great vehicle for holding participations in other companies. This can take the form of a personal portfolio of stocks and shares, or even the Isle of Man company acting as TopCo of a group of companies. Regardless, the UBO will need to confirm whether the Isle of Man company’s activity falls within a Relevant Sector for the purposes of Economic Substance legislation – contained in Part 6A Income Tax Act 1970.

Under Economic Substance, if an Isle of Man company’s sole function is to acquire and hold controlling equity positions in other companies i.e. more than 50% of the company’s share capital, then the company is considered a Pure Equity Holding Company. A Pure Equity Holding Company must demonstrate that its Core Income Generating Activities (CIGA) occur on the Isle of Man. The required CIGA is usually met through the provision of Directors and other management services in the Isle of Man, enabling Adequate Substance to be met.

However, if the Isle of Man company meets these requirements but has no income i.e. no dividends are paid up from the equity holdings, then it falls out of Economic Substance.

You can find the latest guidance on Economic Substance here.

- Real Estate Property Holding: Isle of Man companies are often used to purchase, develop and/or generate income from Real Estate. This option is particularly attractive in circumstances where the UBOs are in a number of geographic locations or outside of the jurisdiction being invested into.

- Yacht Holding: Isle of Man companies are often used for the management of luxury assets. We have particular expertise in Superyacht management structures, whereby we work with industry professionals to deliver a ringfenced and efficient corporate ownership structure. You can read more about our superyacht services here.

- Honourable Mentions: as noted above, in the right circumstances it can be beneficial to hold almost any asset via an Isle of Man company. Other typical assets held by Isle of Man companies include; intellectual property, aircraft, and tangible investment property such as works of art, wine etc.

International Structuring

The Isle of Man provides a great non-EU base from which to structure companies that operate internationally. There are several instances where this makes particular sense:

- Geographic diversity – The company may have Shareholders, workforce or activities that are located within multiple jurisdictions or trade areas;

- Restructuring – An Isle of Man company may be established for the purposes of carrying out acquisitions and mergers. Further where a TopCo needs to relocate to a well-regarded jurisdiction, the Isle of Man company offers a great option for redomiciliation.

- Equity Finance – The company and or its subsidiaries may wish to commoditise their assets to attract new investment i.e. converting immovable assets, such as land and real estate, into shares or debt instruments. New investors would purchase positions within the new TopCo, thereby providing the group of companies with a source of capital for growth etc. You can read more about financing international investment via Isle of Man Companies here.

- Access to markets – As a well-regulated and reputable jurisdiction, the Isle of Man provides a platform for certain types of regulated business to attain and manage licenses to provide international activities e.g. eGaming.

Estate Planning

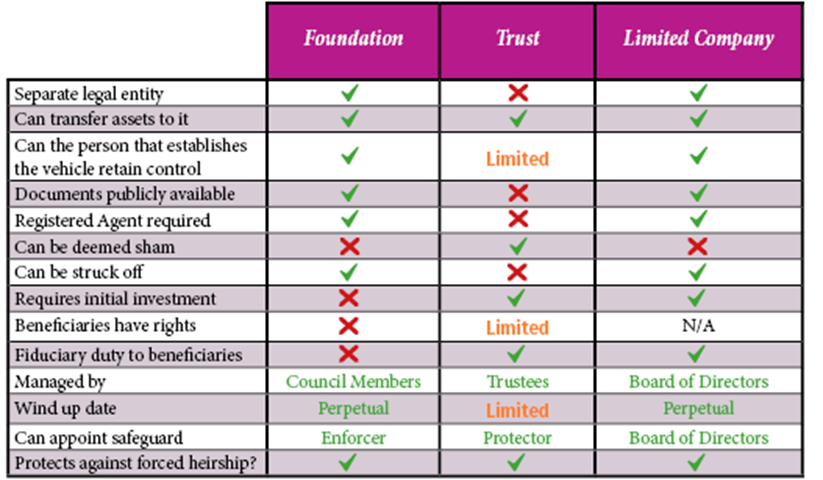

Trusts have been the mainstay of estate planning for generations, delivering a degree of certainty and protection to Settlors and their assets. However, a Trust is not an incorporated entity and therefore has no separate legal personality and limited liability – the Trustees hold legal title of the assets and are responsible for the Trust’s liabilities. Additionally, the Trust cannot engage in commercial activity, and must do so via a company. Further, Trusts are not recognised in all jurisdictions, and therefore predominantly attractive to Settlors from Common Law jurisdictions. You can read more about Isle of Man Trusts in this series of articles.

In recent times, many offshore jurisdictions, such as the Isle of Man and Channel Islands, have introduced legislation to support the use of Foundations. Foundations provide an incorporated vehicle that is comparable to a Trust but possesses separate legal personality and limited liability – albeit there is no share capital. The Foundation is traditionally used within Civil Law jurisdictions. Therefore, the tax treatment of a Foundation is less certain within Common Law jurisdictions such as the UK, and seems to be assessed on a case-by-case basis – in part governed by the purpose of establishment i.e. if formed to carry out company activities it may be treated as per a company. As with the Trust, the Foundation cannot engage in commercial activity, and must do so via a company. You can read more about Isle of Man Foundations in this series of articles.

Isle of Man companies, incorporated under the CA 2006, can be used as a viable alternative to both Trusts and Foundations. Delivering an entity with separate legal personality, limited liability and share capital. Further, companies, unlike Trusts, are recognised as legal structures throughout the world and can engage in commercial activity directly. Therefore, given the right circumstances, an Isle of Man company can present a more efficient option than a Trust or Foundation.

The UBO, or Founder, transfers their assets to the Isle of Man company. Transferring those assets to the Isle of Man company can have tax implications and as such will require tax advice within the Founder’s jurisdiction of domicile and tax residency.

Through the issuance of different classes of share, various powers and rights can be attributed to different parties. For example, issuing a class of shares to the Founder can provide them with voting rights and therefore increased control during their lifetime. This mechanism can also provide the beneficiaries with access to income and/or capital and the appointed Directors with management rights. The class rights would be detailed within the Articles of Association. It is important to note that where the Founder possesses voting rights, this can have tax implications, even though there is no right to participate in income or capital.

Dixcart can provide for the provision of Trustees, Council Members and Directors as required by the client and their adviser, and are well placed to assist in all international planning.

How Dixcart Can Help

Our Isle of Man office has been providing effective structuring and efficient administration for companies for over 30 years and is well placed to assist with all Isle of Man planning.

We have developed an extensive range of offerings which can be tailored to meet the needs of clients and their advisers. Our in-house experts and senior employees are professionally qualified, with a wealth of experience – this means that, from pre-incorporation planning and advice to the day-to-day management of the company and troubleshooting issues, we can support your goals at every stage.

Additional Information

If you require further information regarding the use of Offshore Trusts, or Isle of Man structures, please feel free to get in touch with Paul Harvey at Dixcart: advice.iom@dixcart.com

Dixcart Management (IOM) Limited is Licensed by the Isle of Man Financial Services Authority