Background

The Delacroix family, a European high-net-worth family, had spent generations building wealth across various industries, including real estate, private equity, and financial markets. As their assets grew more complex and spread across multiple jurisdictions, they needed a robust and tax-efficient structure to manage their wealth efficiently, ensuring strategic oversight of investments, protect their assets from external risks (such as legal claims or political instability), and ensure they established a seamless succession plan to preserve the family wealth for future generations.

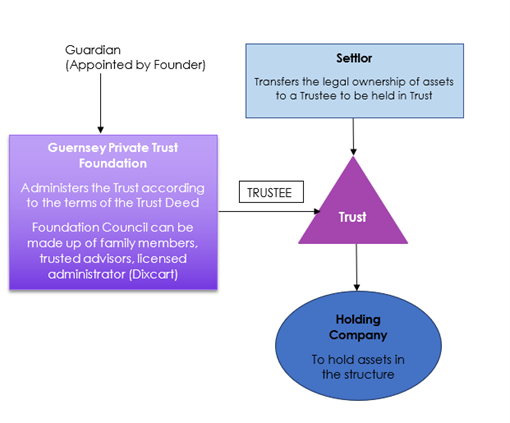

With Switzerland’s financial stability, legal certainty, and strong fiduciary expertise, the family decided to establish a Swiss Family Office using a Swiss Private Trust Company (PTC) structure. With careful planning, the Delacroix family implemented a structure that balanced wealth preservation, regulatory compliance, and investment flexibility while retaining control over decision-making.

Structuring the Swiss Private Trust Family Office

Unlike a traditional Trust where an external Trustee manages the assets, the Delacroix family opted for its own Swiss Private Trust Company (PTC) to act as the Trustee of the structure. This bespoke approach ensured that the Delacroix family retained control over their wealth structure whilst benefiting from Swiss fiduciary expertise and compliance oversight.

- Forming the Swiss PTC

Establishing a Swiss Limited Company allowed the family to:

- Determine the composition of the PTC’s Board of Directors, appointing a mix of family members, trusted advisors, and professionals to guide its governance.

- Recruit and oversee employees responsible for the administration and management of the Trust structure.

- Engage asset managers, tax specialists, and legal advisors to provide expert advice and guidance in investment management, tax structuring, and regulatory compliance.

- Asset Segregation: Creating Multiple Trusts for Different Asset Classes

The Delacroix family possessed a variety of asset classes that required consideration when setting up the PTC. Their assets included, a substantial investment in a Swiss private bank, a luxury yacht, several high-value collectibles, and a portfolio of commercial and residential properties that needed to be customized accordingly. As a result, they decided to establish three separate Trusts to sit within the PTC, each holding the different types of assets:

- Real Estate Trust

- Yacht and Lifestyle Trust

- Portfolio & Investment Trust: Overseeing their financial assets.

- Ensuring a Smooth Succession Plan and Long-Term Governance

One of the most important objectives of the Delacroix family was to also secure the financial well-being of future generations, including minor children, their, grandchildren, and any vulnerable family members. Philanthropy is also important to the family, and as such they wanted to ensure they could continue to support the various charitable initiatives important to them.

With this in mind, the Delacroix family’s succession plan needed to include:

- A governance framework aligned with their family values. The PTC Board defined clear distribution policies to ensure responsible wealth management.

- Predefined conditions for Trust distributions, ensuring that the wealth is transferred to beneficiaries based on age, education, and other milestones as set out by the family.

- Long-term preservation of key assets. Certain assets, such as their family businesses and real estate, were protected from forced sales or external claims.

By structuring the PTC to serve as a multi-generational Trustee, the Delacroix family ensured financial stability, continuity, and governance flexibility over time.

Compliance and Regulatory Considerations

Due to Switzerland’s stringent regulatory framework, it was crucial for the Delacroix family’s PTC to collaborate with a Swiss professional Trustee to ensure full compliance with Swiss anti-money laundering (AML) laws, the Common Reporting Standard (CRS), and FATCA. By controlling the PTC, the family maintained financial privacy, minimising the necessity to disclose sensitive wealth information to external Trustees.

The Outcome

By establishing their family office through a Swiss Private Trust Company, the Delacroix family successfully created a long-term, legally robust and adaptable structure for wealth preservation and intergenerational governance. The structure allowed them to customise the management of their assets, retain full control over all Trustee decisions, facilitate a smooth transition of wealth across generations, subject to their criteria, and ensure full compliance with minimal exposure.

The Delacroix family’s experience highlights why Switzerland remains a premier jurisdiction for high-net-worth families looking for a structured, secure, and tax-efficient family office model. Dixcart Trustees (Switzerland) SA has been providing Swiss Trustee services for over twenty years and has obtained the FINMA license beginning of 2024, demonstrating its adherence to the highest regulatory standards for Trust management and ensuring compliance with Swiss financial regulations to uphold security and integrity. Dixcart Trustees (Switzerland) SA is a member of the Swiss Association of Trust Companies (SATC) and affiliated with the Organisme de Surveillance des Instituts Financiers (OSIF).

If you would like additional information regarding Swiss PTCs, or to discuss if this structure is right for you and your family, please contact Christine Breitler at the Dixcart office in Switzerland: advice.switzerland@dixcart.com.