We have had an extended period of global uncertainty including highlights such as a pandemic, economic disruption, massive inflation and the threat of a new cold war. In such volatile times, how do you plan for future generations? Whilst there will always be market disruption, when it comes to estate and succession planning, you can take heart from the steadfast reliability of licensed and properly regulated Professional Trustees.

In this short article we will discuss some of the key reasons you should be considering a Professional Trustee for your Trust structuring:

- What is a Professional Trustee?

- Why is a Lay Trustee sometimes the wrong choice?

- What do I need to consider when choosing a Professional Trustee?

- How can Dixcart help with my Trust planning?

1. What is a Professional Trustee?

You cannot have a Trust without Trustees, but what is a Trustee and what is the difference between a Lay Trustee and a Professional Trustee?

A Trustee is appointed by the Settlor / Donor of a Trust and is the party that holds legal title to the property and assets that form the Trust Fund. The Trustee must administer the Trust Fund in line with the Trust Deed, their various duties and in the interests of the Beneficiaries. You can read more about the various parties to a Trust and more, here.

Lay Trustees are non-expert Natural Persons, typically family or friends, who are appointed as Trustee by the instigator of the Trust. They will act as Trustee for the lifetime of the Trust, or until incapacitated, death or replacement.

A Professional Trustee can be either a Body Corporate or Natural Persons but is typically a corporate entity such as a Private Limited Company. Professional Trustees are normally qualified experts who will undertake their duties for a fee. The Professional Trustee contracts with the Settlor / Donor to provide services for whole lifetime of the Trust or until they are replaced.

Trusts do not have separate legal personality and therefore ALL Trustees are jointly and severely liable for their actions under a Trust. Additionally, both Lay Trustees and Professional Trustees owe a blend of Common Law and Statutory duties to the Beneficiaries. These duties include responsibilities such as to exercise reasonable care and skill, to fully understand their obligations under the Trust, to avoid conflicts of interest, to act within their powers under the Trust Instrument and to act with impartiality.

Further, as the Trust does not possess separate legal personality and all liabilities linked to the Trust Fund fall onto the Trustees, Trustees can incur tax liabilities within their respective jurisdiction, including having to meet any reporting requirements etc.

Importantly, the nominated party must be willing to act as Trustee, but as you can see, being appointed as a Trustee is a serious undertaking that can be complex and carries a great deal of responsibility.

2. Why is a Lay Trustee sometimes the wrong choice?

‘All animals are equal, but some are more equal than others…’

Orwell’s famous line from Animal Farm seemed to be an appropriate way to open this section – but what do I mean by this?

Whilst the Courts will hold Lay Trustees to account for their actions under the Trust Deed and in line with the Trustee and Fiduciary duties owed, Professional Trustees will be held to a higher standard of care.

For instance, in determining professional negligence, the Court would consider the Professional Trustee’s state of mind / knowledge in line with that of a reasonably competent Professional Trustee, replete with all the knowledge and expertise that a Professional Trustee could be expected to have – including any specialist knowledge that they held themselves out to possess.

Further, whilst UK Professional Trustees are generally not regulated, Isle of Man Professional Trustees must possess a Class 5 License and are regulated by the Isle of Man Financial Services Authority under the Financial Services Act 2008.

The effect of this is threefold:

- Family and/or friends who are appointed as Trustee will be personally liable for their actions, including any potential losses or misinformed actions; and

- If Professional Trustees are engaged, they will be held to a higher standard of care regarding fulfilling their duties under the Trust; and

- All Isle of Man Professional Trustees must maintain a license and are regulated. This provides further protection and quality assurance that the client and their beneficiaries can take comfort from.

When a Lay Trustee is appointed, the Settlor / Donor will not necessarily benefit from any additional protections, and they will not be held to a Professional Standard. There are many more reasons that can help determine whether a Professional Trustee is right for you in the circumstances.

Cons of Appointing a Professional Trustee

Appointing a Professional Trustee is not without its considerations. The main drawback of appointing a Professional Trustee is of course the implicit fees. The size of the Trust Fund will determine whether Professional Trustee services are viable or not.

Where the Trust Fund is below a minimum size, Professional Trustee fees can disproportionately diminish the assets. For example, a Settlement of £100k that incurs Professional Trustee fees of £10k per annum must achieve over 10% growth per year to meet its Professional Trustee costs alone – there can of course be third party fees also (e.g. investment managers, Custodians, Property Managers etc.) – this is of course not viable. Comparatively, a Settlement of £1m with the same £10k Professional Trustee fee will only need to achieve over 1% growth per annum, a much more achievable hurdle.

Therefore, Professional Trustees are typically engaged where the Trust Fund will be valued in the millions+. In such circumstances, the costs of the Professional Trustee and any third parties can be met whilst still experiencing healthy growth via the income, gains and interest accrued.

In such instances, the client is also transferring control of their Settled assets to people they may not have an existing relationship with. However, this concern can be allayed by some of the questions we consider in section 3.

Cons of Appointing a Lay Trustee

Conversely, the main benefits of appointing a Lay Trustee are that the Settlor / Donor will have a prior relationship with them i.e. they will be a known person. The other key benefit is that they will normally act as Trustee for free.

However, there are many important features that make a Lay Trustee a less attractive solution where the Trust Fund and planning allows for a Professional Trustee to be engaged. This includes considerations such as:

Continuity

Unfortunately, unlike Professional Trustees who act via a corporate entity, Lay Trustees can die or lose capacity. This can cause issues for the efficient and effective administration of the Trust and incur costs to remedy. Successor Trustees can be named in the Deed, but the same issues remain, plus there is reliance on proper record keeping and a good handover – as they will not necessarily be stored in a central location, unlike Professional Trustees’ offices.

Lay Trustees’ circumstances are also subject to change. For example they may emigrate for work etc. Where this is the case, apart from the issue of remoteness, as noted previously, it can cause unintended liabilities. The Trustee can pull the Trust into that new jurisdiction’s tax regime, and this may in turn have tax consequences.

A Professional Trustee delivers permanence and certainty with regard to the treatment during their tenure. Further as the company can continue in perpetuity, this feature allows the service provider to have an in depth understanding of the arrangement, the Settlor / Donor and where appropriate the Beneficiaries throughout the whole term of the Trust, which assists in the effective management of the Trust.

Neutrality

As Lay Trustees are persons known to the Settlor / Donor such as family or friends, they very often have ‘skin in the game’ so to speak i.e. they often have an interest – whether directly or indirectly. As previously noted, this is one of the legal duties owed by Trustees.

Where there is an issue with impartiality, conflicts of interest etc. this can compromise the arrangement, be the root of legal action and may even see deviations from the objectives of the Settlor / Donor. Further, Lay Trustees can often fall out, making administration of the Trust harder still.

A Professional Trustee is independent of inter-family relationships and always ensures an unbiased approach to carrying out their duties under the Trust – always actioned in the Beneficiaries best interest and in line with the wishes of the Settlor / Donor.

Burden

Acting as Trustee can be a time consuming, complex and sometimes unwieldly undertaking. This can result in the role being overwhelming and potentially stressful for Lay Trustees, particularly where the Trust Fund comprises significant assets.

Whether carrying out the day-to-day administration, keeping accounts or dealing with third party experts, your Trustees will be taking on an onerous responsibility. Keep in mind that Lay Trustees will often be juggling this role alongside their work and home lives.

Appointing a Professional Trustee, such as Dixcart, outsources this burden to consummate professionals who have dedicated themselves to delivering quality service, keeping your loved ones free of the aches and pains of Trusteeship.

Knowledge & Expertise

Understandably, the majority of Lay Trustees simply do not possess the required knowledge and expertise to optimally administer a Trust. In today’s world, the environment is subject to regular updates, for instance in reporting requirements e.g. FATCA and CRS, registration requirements e.g. the Register of Overseas Entities and changes in the tax, legal or regulatory treatment etc.

Often qualified professionals, such as Dixcart, will have an in-depth knowledge of all pertinent areas and maintain an awareness of best practices.

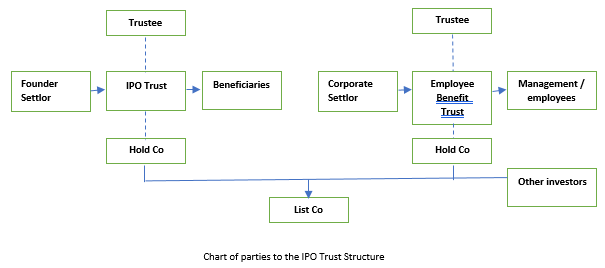

Indeed, specialist knowledge may be needed and therefore a Professional Trustee may be required. For example, it is not uncommon for businesses or groups of companies to seek to implement specialist Trusts, such as Employee Benefit Trusts or Employee Ownership Trusts. In such instances good governance is essential and therefore Professional Trustees can be very beneficial.

The knowledge and expertise of your Professional Trustee can even aid the Trust Fund to meet its targets over time, providing value and cost savings beyond simple administration.

In conclusion, given the correct circumstances, the appointment of an Professional Trustee, such as Dixcart, can mitigate otherwise unwarranted liabilities and provide peace of mind for all parties involved.

3. What do I need to consider when choosing a Professional Trustee?

If you and/or your adviser believes a Professional Trustee is a suitable solution, you may be wondering how to best identify a good Professional Trustee. There are many factors to consider, but below are a few questions that indicate a good quality Trust and Corporate Service Provider:

Is the Trust and Corporate Service Provider Well Established?

The client will want to consider those firms that have a heritage in the industry and who have operated continuously without issue. This displays the service provider’s commitment to operating sustainably and in a compliant manner. A service provider with extensive experience in trust and corporate services will have a deeper understanding of the complexities involved in managing entities. Their experience can help you navigate potential pitfalls and challenges, which can be value-adding. Therefore, the term of trading is an indicator of permanence and reliability.

The Dixcart Group have now been trading for over 50 years and remains privately owned by the same family. Further, Dixcart Isle of Man has been in operation since 1989, which represents a deep and varied knowledge of Trust and Corporate administration. This means that we do not have the same commercial pressures that private equity service providers experience, we only ever undertake compliant structuring and therefore have a quality rather than volume focus.

Does the Trust and Corporate Service Provider have Professionally Qualified and Experienced Staff?

A reliable Trust and Corporate Service Provider should have a team of professionals with relevant qualifications and expertise, such as Accountants, Lawyers, STEP qualified Trustees, Chartered Secretaries etc. They will generally be members of recognised industry bodies and associations.

When dealing with your Trust and Corporate Service Provider you should feel confident that the staff you interact with are well informed, can provide the answers you need and are ideally professionally qualified.

Further, it is also important to have direct contact with senior team members and Directors. When you want something actioned – it needs to be treated as a priority. This is a good indicator of service standards.

At Dixcart your day-to-day matters will be dealt with by professionally qualified senior employees. Additionally, our Directors are aware of every entity that we onboard and fully engage in the services delivered.

Does the Trust and Corporate service provider have a Transparent Fee Structure?

Most admin and compliance carried out by Trust and Corporate Service Providers is typically delivered on a ‘time-spent’ basis, meaning that a pro-rated hourly rate applies. The level of fees due will be in line with the levels of activity required to run the entity. Further the hourly rate that applies to any task will depend on the complexity of the task and expertise required.

When considering your Trust and Corporate Service Provider, you need to ensure that the fees are transparent and that you will never be billed without understanding what it is you are paying for. There also needs to be flexibility built-in, so that regular reviews are undertaken, and the relationship can remain fair for all parties involved.

We will always be open and honest with clients and advisers when it comes to fees, always giving prior warning and attaining client sign-off before actioning anything. At Dixcart we believe that trust is a fundamental building block in developing our relationship with clients and their advisers.

Will you Have a Dedicated Point of Contact?

A good Trust and Corporate Service Provider ensures continuity of service, which in turn minimises potential disruption. Therefore, it is very important that you are able to build long term relationships of trust and understanding with dedicated team members. A low turnover of staff and infrequent changes in you contacts indicate the kind of reliability and stability you will want for any long term planning such as a Trust.

Dixcart’s Isle of Man office has a very low churn rate of employees, with many of our team members being with us for 5+ years and a number serving for circa 20 years.

4. How Can Dixcart Help with My Trust Planning?

Dixcart have extensive experience in all offshore entities and can assist with the setup and ongoing administration of your private client planning and corporate structuring. This includes all forms of Trust and any underlying Special Purpose Vehicles or corporate entities.

Over the last 50 years, we have developed strong working relationships with some of the world’s leading advisers. If you have not yet engaged a professional adviser, we can make an introduction as appropriate.

Get in Touch

If you would like to discuss Professional Trustee services, or Estate and Succession Planning, please feel free to get in touch with Paul Harvey at Dixcart: advice.iom@dixcart.com

Dixcart Management (IOM) Limited is Licensed by the Isle of Man Financial Services Authority