The Guernsey Private Foundation and The Advantages Available as an Alternative to a Private Trust Company

Individuals and families use various structures to protect their assets from uncertainty and volatility and to deal with estate and succession planning matters. Very often asset protection alone is not the principal driver in creating such structures.

It is not uncommon for the next generation of a family to move to new countries to study, work, establish businesses and settle down. As families become more internationally mobile the complexity of administering family estates and assets, as well as cross border succession and estate planning, increases.

Steps, Stages and Structures

Before a family’s estate reaches the size and complexity which requires the establishment of a dedicated, single family office, there are a number of stages through which the structure might transition.

Pooled and enhanced fiduciary support

At an early stage, several disparate family related structures are often transferred to a single fiduciary provider or trustee, with whom the family has a good existing relationship or who has been recommended by a trusted adviser.

These structures will generally take the form of a discretionary Trust or Foundation. The Trustee or Foundation Council can then be instructed to assist with developing the position into a standalone family office position, utilising their knowledge, experience and existing resources of; qualified staff, policies and procedures. At this stage efficiencies are created in the management and administration of the structures under a single provider, the family/adviser relationship is reinforced, and additional cost efficiencies often result.

Private Trust Company (PTC)

For many years the PTC has been the preferred vehicle for administering the assets of wealthy families and many variants have emerged across jurisdictions that specialise in providing them, and whose legislation and regulation are particularly suited to private wealth management. One of the main attractions of the PTC is that decisions, relating to the underlying trusts, are made by directors who are carefully chosen by the family and/or may even be family members.

There are a number of variants of the PTC, which can be limited by shares or guarantee and/or even with separate classes of shares for voting purposes. Consideration as to the level of control exerted over the PTC needs to be carefully considered. Too much control can lead to tax implications.

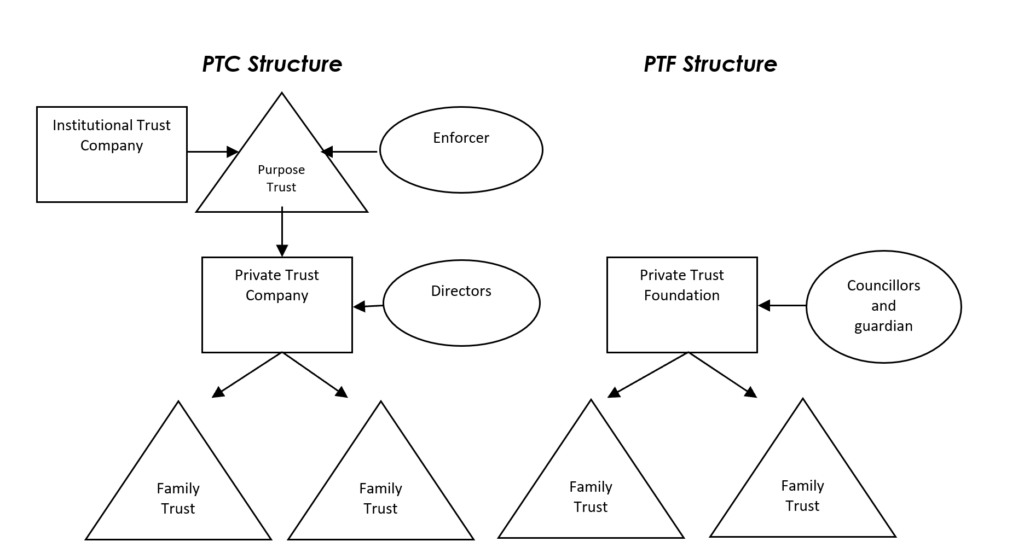

The most common solution to the control issue has been to hold shares in the PTC through a Purpose Trust (see diagram below), which creates additional layers of ownership and administration.

Whilst PTC’s remain a popular specialist solution, Guernsey can also offer a simpler structure through the Private Trust Foundation (PTF).

Private Trust Foundation (PTF)

A PTF removes the need for the ownership layers which are required above a PTC, and can simplify the structure and therefore administration and cost (see diagram).

A PTF established under the Foundations (Guernsey) Law 2012 (the “Law”), must be for the sole purpose of acting as Trustee of the Trusts for the benefit of an individual or family.

The Law makes it clear that, on establishment, a Guernsey Foundation has its own legal personality, independent from that of its Founder and any Foundation officials.

Diagram: A Classic Private Trust Company Structure and the Guernsey Foundation Solution

The Advantages that a Guernsey PTF Offers

- A Guernsey PTF will be run and managed in a similar way to a PTC, with the involvement of a local licensed fiduciary such as Dixcart, but with the significant advantage that, as an orphan vehicle, it does not have any other owners or controllers.

- Family members or other trusted advisers can also be appointed to the PTF Council, which is responsible for acting as Trustee to the underlying family Trusts.

Managed Services

Managed support from a fiduciary provider, is often the penultimate stage in the progressive route towards establishing a full standalone family office, directly employing appropriately experienced staff in the jurisdiction of choice.

Managed Support Available from Dixcart

Managed support, as provided by Dixcart, can include dedicated serviced office space at the Dixcart Business Centre in St Peter Port, and fiduciary, accounting and legal support as appropriate. A fiduciary provider, such as Dixcart, can also help grow and develop the position into a standalone family office, ultimately operating independently.

Additional Information

For further information on private wealth structures and their management, please contact John Nelson, Director, Dixcart Trust Corporation Limited, Guernsey: advice.guernsey@dixcart.com.

Dixcart Trust Corporation Limited, Guernsey: Full Fiduciary Licence granted by the Guernsey Financial Services Commission. Guernsey registered company number: 6512.