Our short series on planning for a superyacht aims to provide a foundation of understanding for those considering building or purchasing a vessel. In this, the second article in the series, we will take a closer look at how the various elements come together in the operation of a superyacht, through two simple case studies.

If you have not read article one and would like to, please follow the link below:

In this article we will take a look at two case studies:

- Case Study 1 considers a 20m yacht (MY-20) for private use only; and

- Case Study 2 takes a look at a 50m superyacht (MY-50) used for both private and charter.

Case Study 1: MY-20

MY-20 is a new build 20m yacht, that has been purchased by a UK resident ultimate beneficial owner (UBO). The purpose of MY-20 is to cruise domestically within the Mediterranean waters, with no intention of sailing internationally. The UBO does not intend to engage a yacht management professional as it will be primarily utilised as a dayboat, and crew will be engaged on a day rate basis.

Ownership

Whilst MY-20 will be used as a private vessel, there are still many potential liabilities that need to be abated. An owning entity is always recommended to mitigate any unwarranted personal liabilities that the UBO may be exposed to through operating MY-20. For example ringfencing any exposure to personal claims e.g. tortious, contractual etc.

Further, to prevent the UBO being deemed an employee or de facto Director of the entity, it is best to utilise a transparent vehicle, such as a Limited Partnership. The Isle of Man Partnership can apply for separate legal personality, and therefore limited liability at outset.

For this arrangement our UBO will be the Limited Partner, whose liability is limited to their contributions to the Partnership. The General Partner has unlimited liability and therefore will be a Special Purpose Vehicle (SPV). Here, the SPV is an Isle of Man Private Limited Company (IOM Co Ltd) which of course also benefits from separate legal personality and therefore limited liability.

As General Partner, IOM Co Ltd will provide management and control of MY-20 and its operations. In doing so, IOM Co Ltd will administer the vessel, including holding board meetings, making decisions, making annual filings, accounts including the settlement of invoices, review and agree any applicable contractual agreements, and of course work closely with the Captain. It is imperative that the UBO is not seen to engage in any of this activity, lest they be deemed a General Partner and defeat the planning.

Flag

The UBO’s choice of flag will define the laws and regulatory standards that MY-20 will sail under. It will also have implications for the ease of administration. Therefore, the choice of registry is an important one.

As MY-20 is due to only sail within EU waters, an EU flag state will make most sense. From the available registries, the Malta Ship Registry is the largest in Europe and one of the biggest ship registers in the world. The Merchant Shipping Directorate defines MY-20 as a private registered yacht, because it is a pleasure yacht used for the sole purpose of the owner, is 6m+ in length, is not engaged in trade and does not carry passengers for consideration.

The Malta flag is beneficial in our case because the registration process is relatively straightforward as the Malta registry is a modern and administratively efficient shipping register.

Registration will only be granted once the Malta Maritime Administration is satisfied that the vessel conforms to all of the manning, safety and pollution prevention standards required by the applicable international conventions. During the registration process relevant evidential documentation is also required. The documentation must include evidence of ownership from a former registry unless the vessel is new.

You can read more about why Malta is a great location for flagging a vessel, here.

Import / Export

Whilst the UBO and owning entity are non-EU resident and MY-20 is a private vessel, Temporary Admission will not be an option as the ensign will be Maltase and the yacht will not be travelling outside of EU waters. Therefore, the UBO must pay VAT on the initial importation of the vessel to an EU Member State, and must carry evidence of this thereafter.

Whilst Luxembourg offers the lowest rate of VAT in the EU @ 17%, it is also landlocked, making it logistically unrealistic to import a yacht there. This means that Malta’s rate of VAT @ 18% is the lowest in the EU for the importation of yachts.

As MY-20 is a 20m yacht, special dispensation must be obtained from the Malta authorities for a one-off voyage to cross the Med and sail to Malta for importation. Malta Customs authority require a valuation of the yacht to approve MY-20’s importation.

Upon approval of the valuation and arrival in Malta, Customs authorities will inspect MY-20 and request the payment of VAT @ 18% based on the value of MY-20. After receipt of payment, Malta authorities will issue a VAT paid certificate, at their discretion.

In order to enact this a Malta VAT agent is required. IOM Co Ltd will engage with Dixcart Malta, who will act as VAT agent to ensure that the yacht is imported properly.

Case Study 1: In Summary

The UBO’s solution calls for an Isle of Man Limited Partnership with separate legal personality, which has an SPV acting as General Partner. MY-20 will be registered in Malta and VAT paid on importation. MY-20 will cruise the Med, and on the proviso that it does not leave EU waters for a period long enough to jeopardise its VAT paid status, then the yacht can continue to be in free circulation in EU waters.

Case Study 2: MY-50

For sake of ease, we will use the same UBO, except the vessel is a 50m superyacht. The UBO has purchased the superyacht with the intention of both private and charter usage, to assist with ongoing upkeep. The superyacht may be used to cruise in the EU and further afield.

Due to the intended arrangement, MY-50 will require a suite of professionals, including a yacht manager, yacht broker, tax adviser, a corporate service provider such as Dixcart and possibly a crewing specialist, if the yacht manager does not provide such services.

For our purposes, we will refer to the superyacht as MY-50.

Ownership

Due to the UBO being a UK resident, the same structuring can be used to ensure the individual is not deemed an employee or shadow Director of the owning entity – a Limited Partnership with an SPV acting as General Partner (IOM Co Ltd).

IOM Co Ltd will administer MY-50 in a similar way to MY-20, managing all board meetings, decisions, annual filings, contracts. This will include the management accounting associated with not only the ongoing maintenance and payment of invoices etc. but also the operation of any charter agreements.

IOM Co Ltd will work closely with the UBO, Captain, yacht manager, yacht broker and tax adviser to ensure that the structuring remains effective and the superyacht is managed efficiently.

Flag

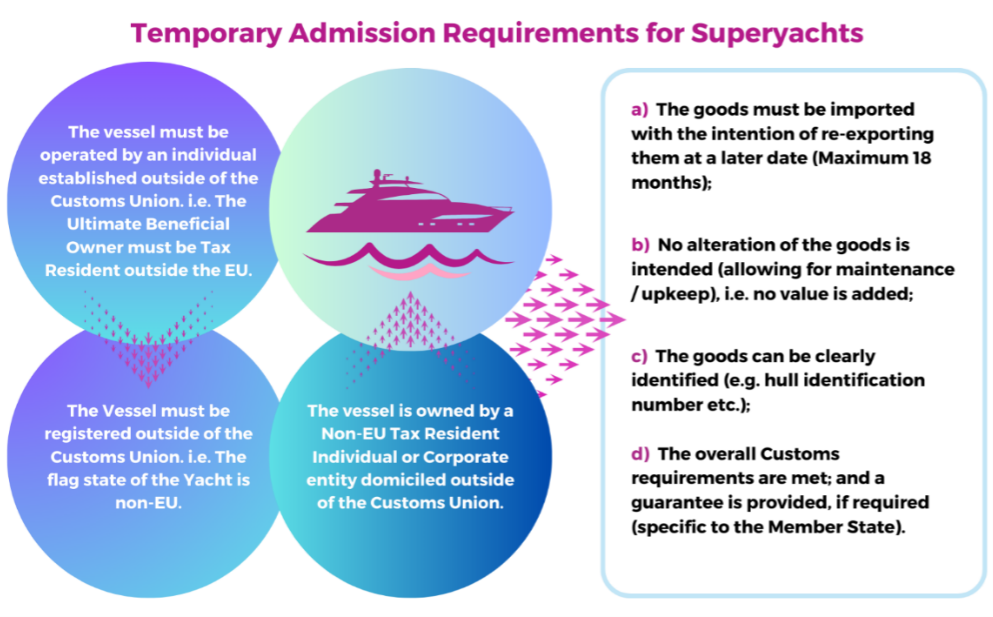

In order to utilise the Temporary Admission VAT procedure when the superyacht is being used by the UBO, a non-EU flag will be required. Temporary Admission allows the vessel to cruise in EU waters for a period of time without VAT being due on import/export. You can read more about Temporary Admission here.

Further, as MY-50 will also be used for commercial charter, the UBO can elect to use the Yachts Engaged in Trade Scheme by registering the vessel in either the Cayman Islands or Marshall Islands. Both options qualify for both Temporary Admission and allow commercial chartering to take place, subject to conditions, and are highly regarded registries.

Yachts Engaged in Trade (YET) Scheme

For those with yachts flagged in the Cayman Islands and Marshall Islands the YET Scheme presents a hybrid approach, whereby the yacht can be used for both private and commercial charters, albeit subject to stringent conditions.

For example, the YET Scheme allows private yachts which are ensigned with the Cayman Island flag to sail under commercial charter in the territories of France and Monaco with VAT exemption. The use of the YET Scheme allows the skipper to switch between YET and Temporary Admission, pausing the 18-month Temporary Admission period, when using the boat for commercial purposes.

Whilst the YET Scheme provides clear benefits to the UBO, there are stringent conditions for use, e.g. the area for commercial charter is restricted whilst in EU waters, the period of commercial charter is restricted to a maximum of 84 days, the yacht must be 24m+ in length and requires a compliance verification survey, a French VAT agent is required etc.

If complied with, the YET Scheme can ensure that no VAT will be payable on the hull importation, and as such will not require disbursement. Correct application of the YET Scheme can provide a cashflow neutral VAT solution. Contravention of any of the requirements may be subject to the application of taxes, penalties or fines by the local authorities.

The YET Scheme is currently limited to the Marshall Islands and Cayman Islands registered vessels.

For our purposes, we will use the Cayman flag.

Case Study 2: In Summary

The ownership of MY-50 will also require an Isle of Man Limited Partnership with separate legal personality, once again meaning that the UBO must have no part in the superyacht’s ongoing management and administration. Further, the flag chosen is non-EU and the vessel is equipped to sail in international waters, therefore the Temporary Admission procedure is applicable when MY-50 is being used as a private superyacht.

As the chosen flag is the Cayman Islands, the UBO can use the YET procedure to commercially charter MY-50 in French and Monegasque waters, subject to conditions. How does this work?

The yacht broker engaged would market MY-50 for those seeking a luxury charter experience. Once a customer has requested to charter MY-50, they work with the yacht manager to create a standardised MYBA charter agreement, detailing the dates of the charter along with the costs applicable to the customer including VAT amongst other information.

Once the agreement has been signed and delivered to the Cayman Islands register, the superyacht is issued a Temporary Certificate of Registry for Yachts Engaged in Trade by the flag state. The certificate will state the limitation period regarding the commercial charter.

When the UBO is onboard, the superyacht is a private vessel and can have free circulation within the EU under Temporary Admission (i.e. there is no charter agreement, fee or VAT required).

Get in touch

If you require further information regarding yacht structuring and how we can assist, please feel free to get in touch with Paul Harvey at Dixcart.

Dixcart Management (IOM) Limited is licensed by the Isle of Man Financial Services Authority.