In recent years, Cyprus has emerged as a prime destination for High-Net-Worth Individuals (HNWIs) acquiring or leasing aircraft. This is due to the highly attractive leasing structure available as a result of the officially named VAT Aircraft Leasing Scheme (VALS), which offers substantial VAT incentives.

Key Features and Benefits of the Structure:

Ownership and Leasing: The private aircraft must be owned by a Cyprus-registered VAT company (the Lessor) and leased to either a physical or legal person established or residing in Cyprus, provided they are not engaged in business activities (the Lessee).

Reduced VAT Rate: Under VALS, the VAT rate can be significantly reduced. The VAT is calculated based on the assumed percentage of time the aircraft flies within EU airspace, and this is determined by two factors: the type of aircraft and secondly, its maximum take-off weight.

Simplified Record Keeping: There is no requirement to maintain detailed records, such as logbooks, for VAT purposes.

Attractive Corporate Tax Rate: Cyprus boasts a competitive corporate tax rate of just 12.5%. When combined with the special VAT rate, this makes the scheme one of the most appealing in the EU.

Global Aircraft Registration: The private aircraft may be registered under any international Aircraft register, and it is not required to be listed under the Cyprus Aircraft Register.

Qualification Requirements:

As can be expected, the VAT savings provided by the programme comes with specific eligibility criteria. At Dixcart, our team of experts are well-versed in these requirements and will support you throughout the entire process to ensure full regulatory compliance.

The primary qualification requirement is obtaining prior approval from the VAT Commissioner. This approval is granted on a case-by-case basis, and the VAT Commissioner reserves the right to reject any application.

As stated above, there are additional qualification criteria to be considered. Our team is at hand to ensure full compliance is met under local and EU regulations.

If you would like to discuss the full list of requirements with a member of our team please let us know by contacting us through our website (www.dixcartairmarine.com) or via email (advice.cyprus@dixcart.com). We are always happy to assist where we can.

How Can Dixcart help?

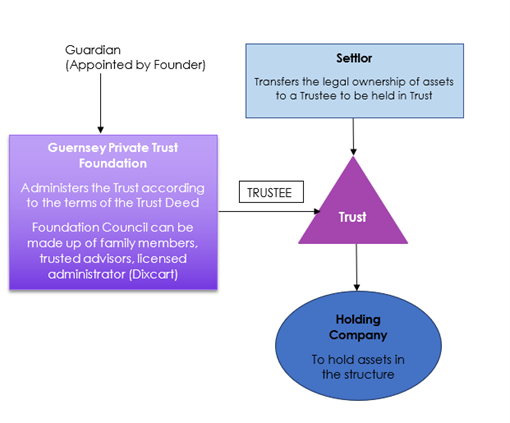

At Dixcart we have over 50 years of experience helping private clients establish and manage companies and international structures. The team in Cyprus is ready to guide you through every step of the process. Below is an overview of the comprehensive range of services we offer from our Cyprus office:

- Formation, administration, and management of Cyprus Companies (e.g., Lessor and Lessee Companies)

- Drafting of lease agreement

- Securing prior approval from the VAT Commissioner

- Coordinating the importation of aircraft into Cyprus and assisting with customs clearance

- Comprehensive due diligence to ensure full compliance with local regulations

- Provision of a variety of other administrative services

If you are considering purchasing an aircraft and are interested in the attractive structing opportunities available in Cyprus, our team is here to assist you.